The month of January 2026 turned out to be optimistic for the Indian startup ecosystem as enterprise capital (VC) funding rose by 30%, pushed largely by a better quantity of offers throughout this era.

The entire VC funding for January 2026 got here in at $927 million throughout 120 offers. In distinction, January 2025 noticed VC funding of $712 million, information compiled by YourStory Analysis reveals. Nevertheless, when in comparison with December 2025, when the funding raised was $1,122 million, it was a decline of 17.3%.

The spotlight for the month of January 2026 has been the amount of offers. That is the best variety of offers on a month-to-month foundation since January 2025. Additionally, the month confirmed the strongest traction within the early stage class of funding with 95 offers, adopted by progress stage at 14 and late with 3.

These traits reveal that regardless of the subdued setting within the total funding momentum, the indicators of exercise within the early-stage funding class reveal that entrepreneurial exercise when it comes to new startups stays, and buyers are backing such ventures.

The VC funding raised in January 2026 got here very near the vital benchmark of $1 billion, and apparently, this occurred regardless of the absence of huge offers i.e, these with a worth of $100 million and above. The important thing offers throughout this month have been Greencell Mobility ($89 million), Arya . ag ($80.5 million), and Juspay ($50 million).

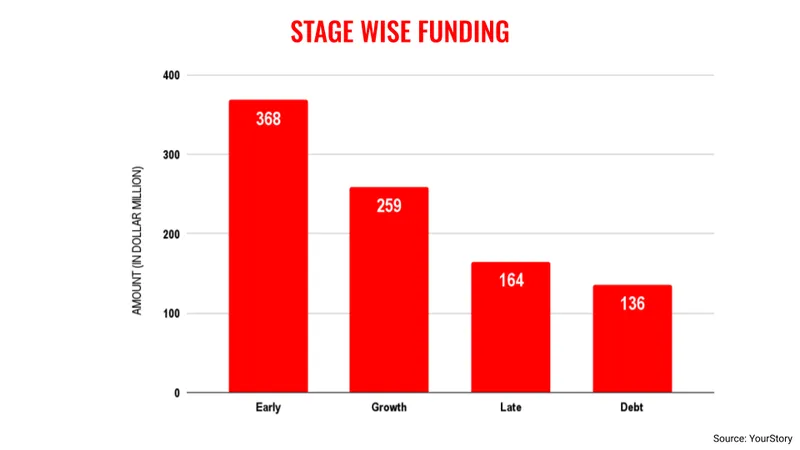

By way of stage-wise funding, the early stage class acquired the best quantity at $368 million, adopted by progress ($259 million), late ($164 million) and debt ($136 million). Typically, it’s the late-stage funding class which determines the influx of capital, as these are largely high-value transactions. January noticed subdued exercise from this class.

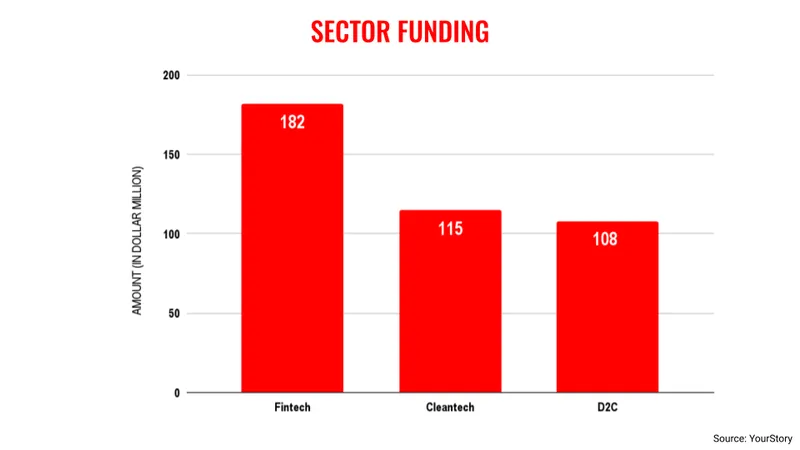

Among the many sectors that acquired funding in the course of the month of January, fintech led the pack with $182 million, adopted by cleantech ($115 million) and D2C ($108 million). The disappointing component right here is the whole absence of any synthetic intelligence (AI) startups elevating funding. Although Emergent, a vibe coding AI startup with sturdy Indian origin raised $70 million in funding, this firm is headquartered in america.

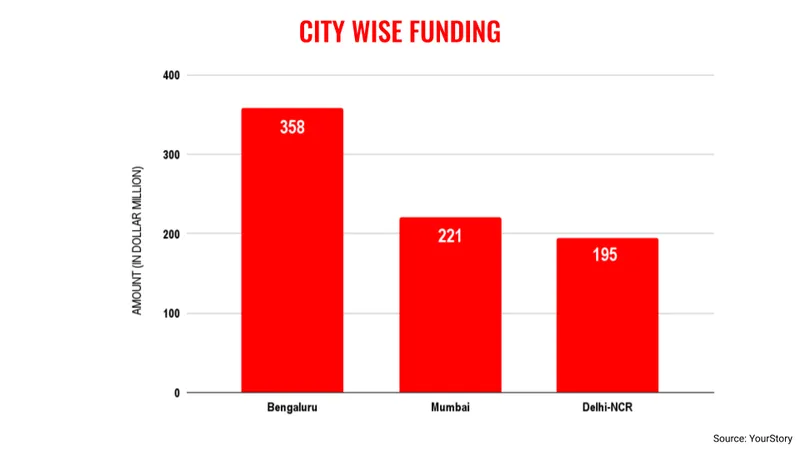

The cities that raised the best quantity of funding within the month of January 2026 remained on the identical monitor. Bengaluru led the record at $358 million, adopted by Mumbai at $221 million and Delhi-Nationwide Capital Area (NCR) with $195 million. This continues to stay a bugbear for the Indian startup ecosystem, the place entrepreneurial exercise and the buyers proceed to be concentrated in these three cities and by no means actually made any significant progress into different metros of the nation.

In truth, for the month of January 2026, Jaipur got here in fourth place, elevating $50 million. This truly requires measures to see that different cities are additionally capable of elevate funding from buyers for the entrepreneurs residing in these places.

The month of January 2026 may be termed as a combined bag for the Indian startup ecosystem as VC funding got here near $1 billion with expanded deal exercise, however couldn’t beat the variety of December 2025.

Elevate your perspective with NextTech Information, the place innovation meets perception.

Uncover the most recent breakthroughs, get unique updates, and join with a worldwide community of future-focused thinkers.

Unlock tomorrow’s traits right this moment: learn extra, subscribe to our publication, and develop into a part of the NextTech neighborhood at NextTech-news.com