-

Token Title: Cryptonite PRO (CPRO)

-

Blockchain: Solana (Token-2022 customary)

-

Complete Provide: 21,000,000,000 CPRO (capped)

-

FDV at Public Launch ($0.03): $630,000,000

-

Preliminary Circulating Provide at TGE: ~4,250,000,000 CPRO (20.2%)

-

Non-Circulating at TGE: 16,750,000,000 CPRO (79.8%)

Cryptonite absolutely commits to CPRO because the ecosystem’s most dear and indispensable forex by extending its utility throughout all app options and advantages.

-

Reductions on paid Cryptonite and Good friend Community memberships

-

Purchase, promote, commerce, and reward experience, affect, and contributions

-

Unique cost for Cryptonite Wizards subscriptions, Tribes membership, and premium options

-

In-chat and message suggestions/rewards through XMTP

-

Reductions on Cryptonite and third social gathering occasions, and companies

-

Embedded self-custodial pockets for seamless in-app use

-

Future: Entry tiers

-

Helius RPC (mainnet + testnet API keys) — configure webhooks for transfers, vesting, withheld charges

-

Token-2022 deployment (mint authority → Squads post-mint) — create with switch charge 20 bp / max 100 bp, authorities as specified

-

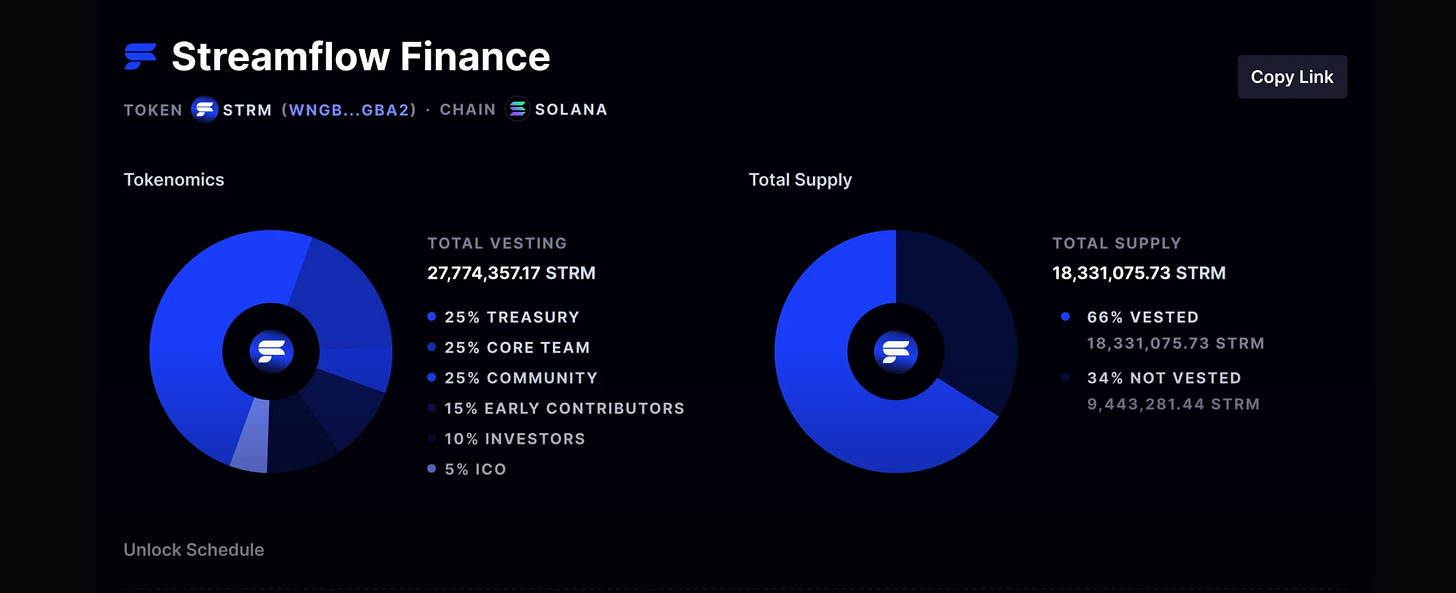

Streamflow — deploy 4 most important vesting streams (recipients = Squads multisig)

-

Squads multisig (3-of-5 or 4-of-7) — treasury vault, buyback/harvest/burn/LP templates

-

Raydium — pool creation scripts examined on devnet

-

Devoted burn pockets/deal with — take a look at burn transactions

-

Privy dashboard — Solana + social/passkey/electronic mail, fuel sponsorship enabled

-

Stripe + NOWPayments service provider accounts — fiat ramps

-

Arweave/Bundlr, Sanity.io, PostHog, Sentry, Retool/Appsmith tasks

-

Grok/Perplexity API keys + native Ollama/Llama.cpp setup

-

0.2% computerized burn on open-market/secondary transfers (user-to-user rewards/suggestions, DEX trades) through Token-2022 switch charge hook (preliminary 20 bp, max 100 bp configurable through Squads multisig)

-

Charges withheld in recipient token accounts (Token-2022 customary)

-

Harvest movement: harvestWithheldTokensToMint (permissionless) → withdrawWithheldTokensFromMint(Squads/approved through devoted pockets upgradable to multisig) → burn to devoted lifeless deal with

-

Crank automation: Helius webhooks (Stage 0) + recurring Bull jobs (~24h or threshold) + Squads proposal templates

-

-

Specific no-fee transfers: presale claims, vesting releases (Streamflow), reward accruals/claims, staking operations (if applied); rewards calculated on gross quantity

-

Authorities & setup: Mint Authority revoked to Squads post-mint; Switch Payment Config Authority = Squads multisig; Withdraw Withheld Authority = preliminary single-key → Squads

-

Devnet E2E testing + exterior audit of charge/harvest movement

-

Transparency: Public burn dashboards + on-chain verification

-

$0.01 → Ongoing restricted pre-sale (Cryptonite Originals, ~10M CPRO) till v0.5

-

$0.02 → v0.5 launch pre-sale (Q2 2026, ~260M CPRO)

-

$0.025 → V1 launch pre-sale (Q3 2026, ~500M CPRO)

-

$0.03 → Public TGE & DEX itemizing (est. June–Oct 2026)

-

Allocation

420M CPRO (2% of complete provide, unlocked at TGE) + X% of cumulative pre-sale proceeds (goal: 50–70% of complete raised, calibrated at TGE to ship ~$150k–$300k preliminary liquidity depth at $0.03 value) → Raydium. -

Pool Construction

Major: CPRO/SOL CPMM pool (50–60% of liquidity) – most well-liked for brand new Token-2022 launches (full-range, set-and-forget, no OpenBook market required, ~0.19 SOL creation price). -

Secondary: CPRO/USDC CPMM pool (40–50% of liquidity) – for stable-pair depth and fiat on-ramp synergy.

Pool Creation & Preliminary Addition (executed through Squads multisig)

-

Devnet script validation full (Stage 0 – Raydium SDK / @raydium-io/raydium-sdk).

-

Mainnet pool creation (CPMM) with preliminary value set to precisely $0.03.

-

Liquidity addition transaction (platform/Squads covers fuel).

-

Obtain LP tokens into Squads treasury vault.

-

LP Token Administration (quick post-creation)

70% → burn to devoted lifeless deal with (e.g. 1Burn… or Token-2022 zero deal with equal) – everlasting liquidity lock. -

30% → time-locked 12 months through Streamflow (linear unlock, recipient = Squads multisig vault).

– Stream created with Squads proposal (3-of-5 or 4-of-7).

– No early withdrawal attainable; charges earned throughout lock nonetheless claimable by Squads.

Publish-Launch Administration

-

Public dashboard (Squads + Streamflow + Helius) exhibiting pool addresses, depth, 24h quantity, and burn/lock standing.

-

Treasury / CPRO Progress Fund approved so as to add supplemental liquidity (through Squads proposal) if depth falls under goal or for buyback assist.

-

No removing of preliminary liquidity permitted till Streamflow lock expires (enforced by governance).

-

Raydium charge tier: default 0.25% (or chosen tier) – buying and selling charges accrue to locked LP place.

-

Danger / Audit Gates

Exterior smart-contract audit of pool creation script + Streamflow integration earlier than mainnet. -

Devnet E2E take a look at: mint → add liquidity → burn 70% → lock 30% → simulate charge harvest.

-

Success metrics at TGE+24h: ≥$100k depth per pool, no >5% slippage on $10k trades, LP burn/lock transactions verifiable on explorer.

-

Founders & Fairness: 3B (14.3%) – 48-month weekly linear from TGE

-

Advisors & Strategic: 1B (4.8%) – 24-month weekly linear from TGE

-

CPRO Progress Fund: 8B (38.1%) – 12-year weekly linear from TGE

-

Treasury/Member Rewards: 4.75B (22.6%) – 12-year weekly linear from TGE

-

Advertising & Distribution: 1.33B (6.3%) – Unlocked at TGE

-

Liquidity Pool: 420M (2%) – Unlocked at TGE

-

Pre-sales: Absolutely unlocked/liquid at TGE (supply through 1:1 migration/declare to major pockets)

Minting of all 21B tokens + liquidity pool creation + Raydium itemizing + 1:1 declare/migration of pre-sale allocations + digital earned balances to person’s major pockets (Privy embedded or linked exterior).

Key Ideas

-

Stage-gate opinions + exterior audits at finish of every stage

-

Full transparency (on-chain vesting, burns, public dashboards)

-

Pre-sale funds directed to liquidity + growth

-

Digital CPRO simulation pre-TGE → actual on-chain at TGE

-

Self-custodial embedded Privy wallets + non-compulsory exterior join

-

Flexibility: timelines, presale parameters, characteristic precedence adjustable primarily based on traction, audits, market situations, regulatory suggestions

-

Devnet E2E testing necessary earlier than mainnet (mint → vesting → presale sim → declare → switch/burn → LP)

-

Full tech stack alignment: Node.js/Specific backend, Subsequent.js frontend, MongoDB/Redis, Bull queues, Pinata/IPFS, and so forth.

-

Dragonfire Safety Layer: Customized part offering foundational safety primitives (encryption mechanisms, zero-knowledge parts for privateness, app-specific safeguards for information integrity throughout on/off-chain flows, delicate information/pockets/transaction safety)

-

No switch charge on staking operations (if added); rewards calculated on gross quantity

-

Helius RPC (mainnet + testnet API keys) — configure webhooks for transfers, vesting, withheld charges

-

Token-2022 deployment (mint authority → Squads post-mint) — create with switch charge 20 bp / max 100 bp, authorities as specified

-

Streamflow — deploy 4 most important vesting streams (recipients = Squads multisig)

-

Squads multisig (3-of-5 or 4-of-7) — treasury vault, buyback/harvest/burn/LP templates

-

Raydium — pool creation scripts examined on devnet

-

Devoted burn pockets/deal with — take a look at burn transactions

-

Privy dashboard — Solana + social/passkey/electronic mail, fuel sponsorship enabled

-

Stripe + NOWPayments service provider accounts — fiat ramps

-

Arweave/Bundlr, Sanity.io, PostHog, Sentry, Retool/Appsmith tasks

-

Grok/Perplexity API keys + native Ollama/Llama.cpp setup

-

Database & Cache: MongoDB Atlas (collections: customers, presaleAllocations, transactionLogs, feeCollection, adminLogs); Redis/Upstash (caching, classes, fee limiting, Bull queues)

-

Backend: Node.js v18+ LTS + Specific + TypeScript; key deps (@solana/web3.js, @solana/spl-token, @coral-xyz/anchor, @privy-io/server-auth, @sqds/sdk, stripe, bull, mongoose, winston, and so forth.)

-

Frontend: Subsequent.js 14+ App Router + React 18+ + TypeScript + Tailwind; key deps (@privy-io/react-auth, @solana/wallet-adapter-*, @tanstack/react-query, posthog-js, @sentry/nextjs)

-

Storage: Pinata/IPFS for metadata/property; Arweave fallback

-

Analytics/Monitoring/Admin: PostHog, Sentry, Retool/Appsmith dashboards

-

Safety/DevOps: Dragonfire integration; env/secrets and techniques administration; Redis-backed fee limiting; Winston JSON logging; Jest + Anchor testing

-

Deliverable: All accounts lively, keys secured, devnet E2E assessments profitable (mint → switch/withheld → harvest → burn; vesting; Privy sim; DB schemas; backend/frontend skeletons; Dragonfire primitives examined).

Focus: Privateness-first v.05 + $0.02 presale reside, (digital CPRO balances/suggestions pre-TGE, actual declare/migration at TGE). All presale purchases recorded in DB; no on-chain token transfers till TGE.

Stipulations/Dependencies (from Stage 0 completion):

-

Helius RPC + webhooks configured for transfers, withheld charges (for future burn cranks), and transaction monitoring.

-

Token-2022 minted on devnet/mainnet-ready (20 bp charge, authorities set: Squads switch charge config, devoted withdraw pockets).

-

Privy absolutely arrange (Solana + passkeys/electronic mail/social, fuel sponsorship, embedded wallets).

-

Streamflow/Squads multisig lively.

-

MongoDB collections prepared (customers, presaleAllocations, transactionLogs, feeCollection).

-

Dragonfire safety primitives built-in (encryption, ZK parts, delicate information/pockets safety).

-

Devnet E2E skeleton working.

Key Additions:

Backend API:

-

/auth/login (Privy server auth verification, session/JWT dealing with, fee limiting through Redis, Dragonfire encryption for delicate information).

-

/presale/allocation (buy logic: validate cost (Stripe fiat or NOWPayments crypto), calculate allocation at $0.02, document in DB with limits, anti-whale checks, KYC/AML hooks if required; assist digital CPRO preview).

-

/presale/declare (simulate digital steadiness preview; at TGE: backend triggers Squads-signed declare to person Privy/exterior pockets, platform covers fuel through relayer/Helius staked RPC).

-

Stripe + NOWPayments webhooks (safe endpoint for cost affirmation, replace allocation standing, deal with refunds/failed tx, logging).

-

Extra endpoints if wanted: /presale/standing, /pockets/steadiness (digital), webhook verification middleware.

-

Safety: Enter validation (Zod/Joi), auth middleware, IP/fee limiting, Winston structured logging, error dealing with.

Frontend:

-

Presale touchdown web page (dynamic content material from Sanity: pricing at $0.02, allocation calculator, buy type with fiat/crypto choices, progress bar for complete raised/remaining).

-

Pockets join modal (Privy embedded + non-compulsory exterior Solana pockets adapter; show major pockets, fuel sponsorship standing).

-

Actual-time declare/standing dashboard (websockets/SSE or TanStack Question polling for allocation steadiness, declare eligibility, transaction historical past).

-

UI/UX: Responsive design (Tailwind), error states, loading indicators, accessibility, PostHog occasion monitoring for buy funnel.

-

Digital CPRO preview show (in-app steadiness earlier than TGE).

Sanity.io CMS:

-

Schemas for app textual content, dynamic pages (presale touchdown, FAQ, phrases), member profiles (if early entry), hero banners, pricing tiers.

-

Workflow: Content material publishing pipeline, preview mode in Subsequent.js, webhook integration for real-time updates.

-

Governance: Versioning, approval course of for delicate textual content (authorized/disclaimers).

XMTP Full Setup:

-

E2EE messaging integration (user-to-user, group chats).

-

Digital in-chat CPRO suggestions/rewards (simulate suggestions in DB, show pending steadiness; no actual switch charge/burn till TGE).

-

Privateness focus: Leverage XMTP’s encryption + Dragonfire ZK/privateness primitives the place relevant; future Confidential Transfers prep.

-

UI elements: Chat interface, tip button/modal with quantity selector.

-

Testing: Finish-to-end message + tip simulation.

Extra Stage 1 Parts (really useful so as to add explicitly):

-

Presale Circulation Integration: Full E2E buy → allocation → digital steadiness → declare preview (devnet sim first, then mainnet staging).

-

Relayer Service: Safe tx signing/submission (Helius staked RPC) for claims/fuel sponsorship from Squads funds.

-

Monitoring & Analytics: Sentry error monitoring, PostHog funnel analytics (conversion charges, drop-offs), Retool dashboards for presale metrics (raised, allocations, customers).

-

Testing: Unit/integration assessments (Jest), E2E presale movement (Cypress/Playwright on devnet), safety scans, load testing for cost endpoints.

-

Deployment: Staging atmosphere, CI/CD pipeline, environment-specific configs (secrets and techniques through env vars).

-

Compliance/Privateness: Evaluation presale phrases for regulatory suggestions, information privateness (GDPR alignment), audit log for all allocations/transactions.

Gate: Safety Audit + Presale Traction Evaluation:

-

Exterior sensible contract/protocol audit (Token-2022 config, relayer, any Anchor applications) + backend/frontend penetration testing.

-

Inside Dragonfire overview.

-

Traction metrics: Minimal pre-sale raised, person signups, engagement (chats/suggestions), holder distribution preview.

-

Stage overview assembly: Alter timelines, options, or parameters primarily based on traction/market situations.

Different Issues:

-

Success Metrics: Presale reside and useful, digital CPRO flowing (suggestions/allocations), profitable devnet → staging E2E assessments, constructive audit findings, outlined traction thresholds for gate approval.

-

Dangers: Cost webhook reliability, fuel price volatility (mitigated by sponsorship), presale demand overwhelming DB/relayer, privateness edge circumstances.

-

Timeline inside Q2 2026: Break into weeks/sprints (e.g., API + DB first, then frontend integration, then XMTP/testing, ultimate audit/gate).

Focus: Full dApp utility + neighborhood options

Key Additions:

Backend API & Integrations (broaden current)

-

/auth/login → Add JWT/OAuth flows, fee limiting, session administration, and KYC/AML hooks if required for presale.

-

/presale/allocation → Embody endpoints for person eligibility checks, tiered allocations, anti-bot/Sybil measures (e.g., pockets age/quantity checks through Helius APIs).

-

/presale/declare → Element webhook dealing with for Stripe/NOWPayments (idempotency, error retry, refund flows), plus person dashboard for declare standing.

-

Extra endpoints: /person/steadiness, /staking/stats (if staking reside), /presale/data (public sale progress, onerous/tender cap).

Safe Relayer Service (essential for gasless claims)

-

Implementation: Use established patterns (e.g., Octane-inspired or Helius staked endpoints for precedence).

-

Safety: Fee limiting, signature verification, whitelisting allowed directions/applications, nonce/replay safety, monitoring for abuse.

-

Funding & Ops: Squads multisig for charge pockets, auto-topup logic, fallback if Helius RPC points.

-

Gasoline estimation & sponsorship coverage (e.g., max charge per tx, per person each day restrict).

BullMQ Jobs & Background Processing

-

Add extra recurring/cron jobs: e.g., presale progress monitoring/alerts, staking reward accrual snapshots, compliance reporting.

-

Error dealing with/retries, dead-letter queues, dashboard (Bull Board or customized).

-

Scaling: Redis config, employee concurrency, monitoring (Prometheus + Grafana if superior).

Gate: Full Good Contract Audit + TGE Readiness (broaden closely)

-

Audit scope: Presale contract/program (if customized), staking program, token mint (SPL Token-2022 if extensions used), any PDAs/vaults.

-

Auditor choice (prime corporations like OtterSec, Sec3, Neodyme, or Certik for Solana).

-

Pre-audit: Inside code overview, static evaluation (cargo-audit, clippy), Slither-like instruments if relevant.

-

TGE readiness: Token mint revocation (freeze/mint authority to null if deliberate), liquidity provision plan (e.g., Raydium pool setup post-presale), vesting/lockup contracts for crew/early contributors, burn mechanisms if any.

-

On-chain verification: Program deployed & verified on Solana Explorer, IDL revealed.

Extra Beneficial Gadgets (typically lacking in early plans)

-

Frontend/DApp: Presale UI (pockets join, allocation checker, declare button), staking dashboard (stake/unstake, rewards preview), responsive + cellular assist.

-

Testing: Finish-to-end (presale movement, declare, stake/unstake), load testing (simulate many claims), devnet → testnet → mainnet migration plan.

-

Monitoring & Safety: On-chain monitoring (Helius webhooks for occasions), alerting (e.g., failed claims, suspicious tx), bug bounty program launch.

-

Compliance & Authorized: Token classification verify (utility vs. safety), KYC/Geo-restrictions for presale if wanted, phrases of service/privateness coverage.

-

Documentation & Group: Up to date whitepaper/tokenomics, dev docs (API spec, staking information), neighborhood beta testing (e.g., restricted presale take a look at spherical).

-

Contingency: Rollback/rescue plans (e.g., upgradeable program if utilizing Anchor 0.30+), emergency multisig controls.

Focus: Token technology (full mint), liquidity pool creation + LP token administration, mass claims/migration, vesting activation, switch charge/burn mechanism reside, and buying and selling enabled on Raydium.

Stipulations/Dependencies (from Stage 0–2 completion):

-

Helius RPC + webhooks absolutely configured (transfers, withheld charges, vesting occasions)

-

Squads multisig (3-of-5 or 4-of-7) operational with treasury vault, pre-funded SOL/fuel, harvest/burn/LP proposal templates

-

Streamflow vesting streams deployed (4 most important streams to Squads)

-

Privy embedded wallets + fuel sponsorship enabled

-

Relayer service safe and examined (Helius staked RPC, rate-limited, whitelisted directions)

-

Raydium pool creation scripts validated on devnet/mainnet-beta (Raydium SDK)

-

BullMQ jobs working (harvesting, batch processing)

-

Dragonfire Safety Layer lively (encryption, ZK/privateness primitives, transaction safety)

-

DB snapshot prepared (presaleAllocations + digital earned balances at TGE timestamp)

-

Remaining exterior audit full + all devnet/mainnet E2E simulations handed

Pre-TGE Preparation (4–6 weeks previous to execution window)

-

Remaining full-scope exterior safety audit (Token-2022 config/extensions, relayer, declare movement, burn harvest logic, Raydium integration, Streamflow vesting) + penetration testing + bug bounty kickoff

-

Mainnet phased dry-run simulation (mint take a look at provide → LP → pattern claims → transfers/burns → vesting launch → alerts)

-

Safe key custody: Squads treasury, withdraw withheld authority (preliminary single-key → improve to Squads), devoted burn pockets (1Burn… or equal lifeless deal with), relayer signer

-

Pre-fund Squads vault sufficiently for claims, harvests, and proposals

-

Finalize Raydium swimming pools: verify 420M CPRO (2%) + calibrated portion of pre-sale proceeds (goal $150k–$300k preliminary depth at $0.03); 50–60% CPRO/SOL CPMM, 40–50% CPRO/USDC CPMM

-

Deploy token metadata (JSON hosted on Pinata/Arweave: identify “Cryptonite PRO”, image “CPRO”, description, brand, web site/socials; initialize-metadata pointer extension)

-

Configure dashboards: Helius (occasions), Retool/Squads/Streamflow (LP, vesting, burns), PostHog/Sentry (person/buying and selling), Dune/Helius holder distribution tracker

-

Advertising/neighborhood: announcement timeline, Raydium coordination, anti-snipe/MEV safety (e.g., preliminary liquidity depth targets), non-compulsory neighborhood engagement plan

-

Regulatory/compliance ultimate verify (utility token emphasis, KYC/AML on ramps, geo-restrictions if wanted)

TGE Execution Sequence (one-time occasion, <4-hour window really useful)

-

Mint full 21,000,000,000 CPRO to preliminary authority pockets (Squads-controlled) utilizing:

textual content

spl-token create-token --decimals 9 --program-id TokenzQdBNbLqP5VEhdkAS6EPFLC1PHnBqCXEpPxuEb --transfer-fee 20 100-

→ initialize-metadata → full mint → instantly revoke/disable mint authority (set to null/Squads)

-

Set remaining authorities: Switch Payment Config → Squads multisig; Withdraw Withheld → devoted/upgradable pockets

-

Create Raydium CPMM swimming pools, add precise liquidity, obtain LP tokens to Squads vault

-

Instantly: burn 70% LP tokens to devoted lifeless deal with; create Streamflow stream for remaining 30% LP tokens (12-month linear unlock to Squads vault)

-

Activate Token-2022 switch charge (0.2% preliminary, max 100 bp configurable)

-

Execute 1:1 declare/migration: snapshot DB → batch transfers (Bull jobs the place attainable) or particular person relayer txs from Squads → person major wallets (Privy embedded or linked exterior); platform covers fuel; embrace fee limiting, anti-bot, retry logic

-

Activate all vesting streams (founders 3B/48mo weekly linear, advisors 1B/24mo, development fund 8B/12yr, treasury/rewards 4.75B/12yr) — first releases start at TGE timestamp

-

Affirm swimming pools public/tradable (swaps enabled, charts reside on Raydium/DexScreener)

Publish-TGE Go-Dwell & Stabilization (quick–first 7 days)

-

Activate burn crank: Helius webhooks + recurring Bull jobs (~each 24h or threshold e.g. ≥1M CPRO withheld) → harvestWithheldTokensToMint (permissionless) → withdrawWithheldTokensFromMint (Squads) → burn to lifeless deal with. No charges on presale claims, vesting releases, staking (if applied), or reward operations (rewards on gross quantity)

-

Full monitoring stack reside: alerts for quantity spikes/dumps (>X% in 1h), giant transfers (>1% provide), excessive withheld accumulation, failed txs/claims, holder focus

-

Launch preliminary advertising push and ensure buying and selling enablement

-

Implement no switch charge on particular operations through instruction checks or program logic

Success Metrics (goal first 24–72h)

-

Liquidity depth: ≥$150k–$300k per pool, ≤5% slippage on $10k trades

-

Quantity: robust preliminary buying and selling quantity (goal >$500k–$1M 24h)

-

Holder distribution: >5,000–10,000 distinctive holders, prime 10 wallets <30–40% focus

-

Burn fee: lively 0.2% on secondary transfers/suggestions/DEX trades; first harvest/burn ≥$10k–$50k equal

-

Consumer development: excessive declare completion fee (>80–90%), lively wallets post-TGE, app engagement metrics (PostHog)

-

Extra: no essential incidents (hacks, failed claims >1%, LP points), value stability, on-chain vesting transparency, profitable first burn cycle

Danger Mitigation & Contingencies

-

Failed mint/LP: rollback plan (revoke authorities, pause claims, public communication)

-

Multisig compromise/emergency: predefined pause/rescue procedures

-

Declare overload: fee limiting, queuing, each day caps per pockets

-

MEV/snipe: preliminary deep liquidity + monitoring

-

Dragonfire lively for all delicate flows

Deliverables

-

On-chain proofs: mint tx, LP creation/add/burn/lock txs, vesting activation, first burn tx

-

Public dashboard reside (burned provide, circulating provide, LP standing, vesting progress)

-

Publish-mortem report (technical + metrics overview)

-

Squads proposal templates (harvest, supplemental liquidity, charge updates)

Gate: Stage-Finish Evaluation

-

On-chain transparency verification

-

Burn mechanism & no-fee guidelines validated reside

-

Liquidity/quantity/holder metrics overview

-

Consumer development & declare success evaluation

-

Alter priorities per Key Ideas (market, audit, regulatory suggestions)

Estimated Timeline inside June–Oct 2026 window

-

Preparation: 4–6 weeks

-

Dry-run: 1–2 weeks earlier than

-

Execution window: single coordinated day (e.g., weekend for decrease volatility)

-

Stabilization: 1–2 weeks monitoring/overview

This plan prioritizes the present core spec (21B provide, 0.2% burn focus, staged rollout) whereas incorporating technical depth for safe, scalable execution.

As founder/proprietor, I wish to prioritize mastery of the Squads & Streamflow platforms for safety, transparency, and management. These platforms are on-chain, audited, and extensively used for Solana token launches. They align instantly with our plan:

-

Squads controls authorities (mint/switch charge/withheld), treasury actions (harvest/burn/LP/supplemental liquidity), and proposals;

https://docs.squads.so/most important/navigating-your-squad/dashboard

-

Streamflow handles the 4 long-term vesting streams (founders 3B/48mo, advisors 1B/24mo, development fund 8B/12yr, treasury/rewards 4.75B/12yr) + 30% LP token lock (12-month linear to Squads).

https://docs.streamflow.finance/en/articles/9670473-create-a-token-lock

Squads Multisig (squads.so / app.squads.so)

Squads is a Solana-native multisig platform constructed on Squads Protocol for safe crew/DAO treasury administration.

Key capabilities:

-

Create a “Squad” pockets with configurable threshold (e.g., 3-of-5 or 4-of-7 signers for top safety).

-

Vault holds SOL, SPL tokens (CPRO), NFTs, and manages authorities (set as mint authority, switch charge config authority, withdraw withheld authority).

-

Proposal/voting system: Create proposals for transactions (transfers, burns, harvest, Raydium LP creation/add/burn/lock, Streamflow interactions, charge fee modifications); members approve (threshold met), then execute. Separate approve + execute really useful for security.

-

Templates for recurring actions (harvest/burn, buyback, supplemental LP).

-

Program upgrades, token metadata administration, integrations with Raydium, SPL Token-2022, Streamflow.

-

Dashboard for monitoring vault balances, proposals, streams/locks (when built-in).

-

Safety: On-chain enforcement by Solana validators; no centralized custody. Finest practices: excessive thresholds (4/6+ for essential), {hardware} wallets (Ledger/Trezor), segmented vaults (scorching/chilly), bug bounties, exterior audits. Deployment price: ~0.1 SOL + lease (~0.003 SOL). Devnet/mainnet supported.

Streamflow (streamflow.finance / app.streamflow.finance)

Streamflow is Solana’s main token distribution protocol for vesting, streaming funds, airdrops, and token locks.

Key capabilities:

-

Vesting/Streaming: Customized schedules (linear weekly, cliffs, periodic unlocks). Auto-release and switch tokens on schedule (no guide cranks wanted). Batch creation for a number of recipients. Revocable/irrevocable choices.

-

Token Lock: Lock SPL tokens or LP tokens for fastened intervals (e.g., 12 months linear unlock to a recipient like Squads multisig). Preferrred for the 30% LP lock (charges earned throughout lock nonetheless claimable by Squads).

-

Multisig Integration: Set Squads multisig as recipient/proprietor of streams or locks. Handle (withdraw, top-up, cancel, declare) through Squads proposals (Streamflow contract calls).

-

Dashboard: Observe open streams/locks, balances, unlock progress, public verification (search by token). Bulk import CSV for recipients. SDK for backend integration.

-

No-fee exceptions align together with your plan (e.g., vesting releases bypass switch charge). Safety: Audited contracts, on-chain transparency. Devnet assist for testing.

Integration: Squads vault receives vested/unlocked tokens or LP; proposals in Squads name Streamflow directions (create/declare/handle).

Safety Finest Practices

-

Use {hardware} wallets (Ledger/Trezor) for all signers.

-

Threshold: Begin with 3-of-5 (add trusted crew/advisors); take into account 4-of-7 for treasury post-TGE.

-

Separate approve vs. execute; keep away from auto-execute.

-

Take a look at every thing on devnet first (necessary E2E per Key Ideas).

-

Exterior audit earlier than mainnet activation.

-

Monitor through Squads/Streamflow dashboards + Helius/PostHog/Sentry/Retool.

-

Doc all keys, proposals, and txs publicly for transparency.

-

As CEO: You create the Squad initially (management deployment); add members later through proposal. Fund preliminary SOL (~0.2–0.5 SOL per atmosphere).

Stage 0: Third-Social gathering Service Setup & Accounts (Feb–Mar 2026) – Core Creation & Devnet Testing

-

Create Squads multisig (devnet first): Go to app.squads.so (or devnet.squads.so) → Join pockets (Phantom/Backpack) → “Create a Squad” → Title it (e.g., “Cryptonite Treasury”) → Add preliminary members (your pockets + 2–4 trusted) → Set threshold (3-of-5) → Affirm & pay deployment charge (~0.1 SOL + lease). Be aware Squad deal with.

-

Fund Squad vault with take a look at SOL/tokens (devnet).

-

Create proposal templates: For harvest/burn, LP actions, Streamflow interactions (save frequent directions).

-

Arrange Streamflow (devnet): Join pockets → app.streamflow.finance → Create 4 take a look at vesting streams (linear weekly from future “TGE” date, recipients = Squads multisig deal with, completely different quantities/intervals matching your allocations). Take a look at cancel/top-up/withdraw through Squads proposal.

-

Take a look at Token Lock: Create a take a look at LP lock (30% equal, 12-month linear to Squads).

-

Improve Streamflow withdraw authority to Squads if wanted.

-

E2E take a look at: Simulate vesting launch → tokens arrive in Squad vault; lock/unlock movement.

-

Migrate to mainnet: Repeat creation (new Squad + streams/locks), safe keys, audit integration.

-

Deliverable: Squad operational, 4 vesting streams deployed (recipients = Squads), LP lock template prepared, devnet E2E profitable.

Stage 1: v0.5 Launch + $0.02 Pre-Sale (Q2 2026) – Preparation & Digital Simulation

-

Squads: Use for presale fund custody (fiat/crypto ramps → Squad vault). Create proposals for digital allocation changes or refunds. Take a look at fundamental transfers/harvest templates.

-

Streamflow: No reside vesting but (digital CPRO simulation in DB). Create placeholder streams on mainnet (small take a look at quantities) or hold devnet. Take a look at recipient movement to Squads.

-

Integration take a look at: Simulate declare preview → future Streamflow launch. Add monitoring dashboards.

-

Gate prep: Evaluation Squad/Streamflow safety in audit (presale traction overview).

Stage 2: V1 Launch + $0.025 Pre-Sale (Q3 2026) – Superior Testing & Readiness

-

Squads: Increase members if wanted (through proposal). Take a look at advanced proposals (Raydium pool scripts, charge harvest templates, supplemental liquidity). Combine relayer signing if Squads indicators claims.

-

Streamflow: Deploy/take a look at ultimate vesting parameters (precise quantities, weekly linear from deliberate TGE timestamp). Take a look at LP lock creation (12-month to Squads). Batch take a look at releases/withdrawals through Squads proposals.

-

Full E2E: Presale funds → Squad vault → simulate vesting begin → tokens unlock to vault. Take a look at staking (if prioritized) no-fee bypass.

-

Gate: Full sensible contract audit contains Streamflow/Squads integration + TGE readiness (vesting activation plan).

Stage 3: Public Itemizing at $0.03 + TGE Execution (June–Oct 2026) – Full Activation & Operations

Pre-TGE (4–6 weeks earlier than):

-

Squads: Pre-fund vault for fuel/claims/harvests. Finalize templates (harvest, burn, LP burn/lock, charge config replace). Safe withdraw withheld authority (improve to Squads).

-

Streamflow: Create/finalize 4 most important vesting streams (precise allocations, weekly linear from TGE timestamp, recipient = Squads multisig). Create LP lock contract (30% LP tokens, 12-month linear unlock to Squads).

TGE Execution:

-

After mint/LP creation: Squads receives LP tokens → proposal to burn 70% → create Streamflow lock for 30%.

-

Activate vesting streams (first releases start). Squads receives vested tokens per schedule.

-

Claims movement: Backend/relayer → Squads proposal/signal → person pockets (fuel sponsored).

Publish-TGE Stabilization:

-

Activate burn crank (Helius/Bull jobs set off harvestWithheld → Squads withdraw → burn).

-

Ongoing: Squads proposals for harvests (24h/threshold), supplemental LP, charge updates (0.2% → max 1%). Monitor unlocks in Streamflow dashboard → tokens to Squad vault.

-

Success metrics verification: On-chain vesting progress, LP lock standing, burn quantity.

-

Gate: Stage overview (transparency, reside burn verified, holder metrics).

Ongoing Mastery Ideas for You (CEO)

-

Weekly overview: Squads dashboard (proposals, vault) + Streamflow dashboard (unlock schedule, locks).

-

Emergency controls: Predefine pause/rescue proposals.

-

Coaching: Share read-only entry initially; run simulations with crew.

-

Prices: Minimal ongoing (Streamflow charges low; Squads lease coated by vault).

-

Audit: Embody each platforms in each stage-gate audit.

-

Sources: Squads Docs (docs.squads.so), Streamflow Docs (docs.streamflow.finance), Discord communities for assist.

This plan ensures safe, clear execution matching your Key Ideas (stage-gates, audits, devnet E2E, transparency). Begin with devnet Squads + Streamflow creation this week. If you happen to want screenshots, video walkthroughs, proposal templates, or assist drafting an inner ops information/RACI matrix, let me know!

Elevate your perspective with NextTech Information, the place innovation meets perception.

Uncover the most recent breakthroughs, get unique updates, and join with a worldwide community of future-focused thinkers.

Unlock tomorrow’s tendencies at present: learn extra, subscribe to our e-newsletter, and develop into a part of the NextTech neighborhood at NextTech-news.com