For many years, People discovered learn how to handle cash by way of banks, monetary advisors, and legacy media. That belief mannequin is now fracturing, Don Silvestri argues. Extra persons are turning to creators throughout social media for steerage on debt, budgeting, investing, and long-term monetary stability.

As President of Debt.com, Don – a longtime digital media and advertising and marketing govt and former NFL skilled soccer participant – has repositioned the corporate round this shift, reimagining its FinTalk Awards to replicate how monetary belief is now constructed on-line.

The Breakdown of Institutional Monetary Authority

Financial cycles, debt crises, and rising monetary complexity are usually not new. What is new, in accordance with Don, is how overtly individuals now talk about cash, and who they belief once they do.

“The financial system modifications. There are ebbs and flows,” he says. “However what hasn’t occurred till the final 10 years is that there’s extra of a dialog now. There’s extra transparency about cash challenges.”

Traditionally, monetary steerage flowed top-down; customers have been anticipated to belief banks, advisors, or monetary journalists they’d by no means met. That mannequin assumed authority was conferred by credentials and establishments. Immediately, Don believes that assumption now not holds.

“What used to occur is you’d go to the highest information sources and belief the author,” Don says. “Now it’s flipped.”

He notes that a part of that shift is structural: debt has change into extra frequent, extra seen, and extra emotionally charged. Bank cards, pupil loans, housing prices, and inflation contact each day life in ways in which summary monetary recommendation typically fails to deal with. On the identical time, confidence in establishments has eroded, leaving customers skeptical of one-size-fits-all options.

That skepticism created house for a unique form of authority.

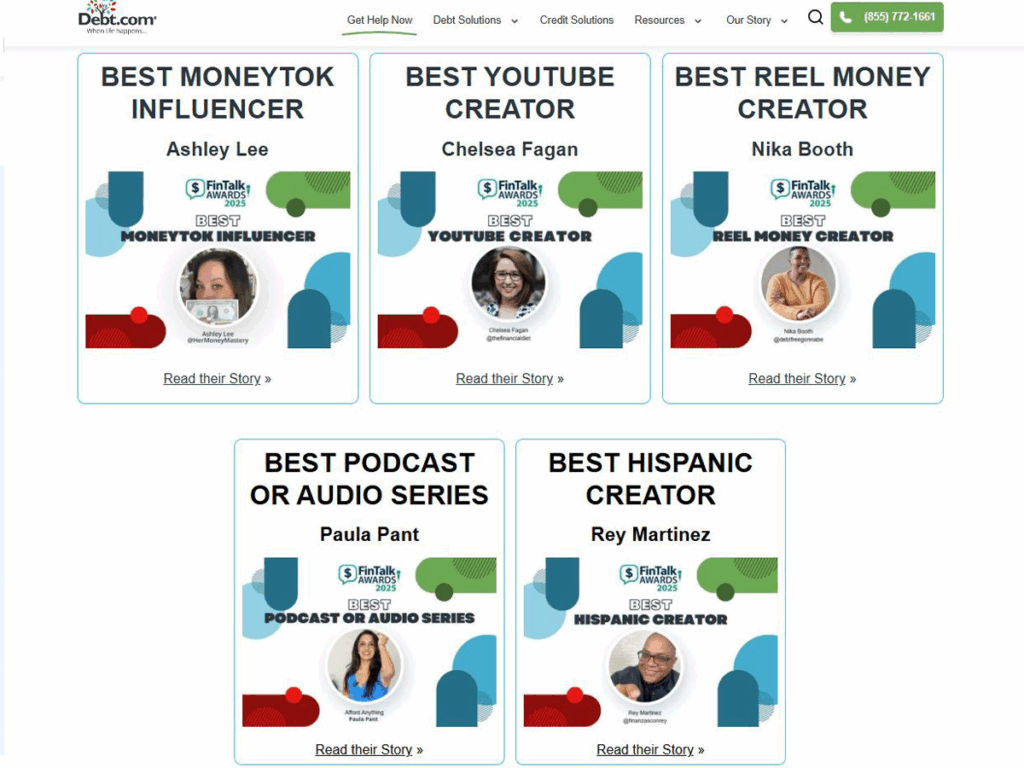

Picture: Debt.com homepage

Supply: Debt.com

Why Creators Have Grow to be Monetary Belief Brokers

Creators didn’t exchange establishments in a single day, as Don factors out. They crammed a spot establishments struggled to deal with: relatability.

“When Fb first launched, it was about sharing gossip. When Instagram launched, it was about meals and vogue photographs. When TikTok launched, it was about dancing and courting. Now, all these platforms have matured,” he explains. “Monetary educators have discovered a brand new dwelling, with a brand new approach of reaching People the place they reside, which is frankly on their telephones. I don’t know what the subsequent social media platform shall be to catch hearth, however I’m pretty sure that, after a couple of years, monetary training will thrive there.”

Don additionally notes the shift towards the “world of storytelling,” including that “individuals resonate towards [creators]. ‘I’m a single mother,’ ‘I’m a dad struggling,’ ‘Do I want a second job?’ Any individual else is doing it and speaking about it.”

In contrast to conventional monetary specialists, creators typically share their private context: errors, debt totals, tradeoffs, and emotional pressure. For audiences navigating related conditions, that transparency feels safer than polished institutional messaging.

“You didn’t see that 20 or 30 years in the past,” Don says. “However you’re seeing it now.”

He provides that this isn’t nearly platform choice. It displays a deeper recalibration of belief. Individuals more and more imagine those that have lived the issue over those that merely clarify it.

“I might a lot quite belief any person that I’ve a relationship with,” Don says. “That’s why individuals go to their dad and mom. Now it’s simpler to construct that relationship with somebody on-line.”

He argues that creators have change into intermediaries, bridging monetary complexity and human expertise.

Debt.com’s Strategic Pivot Towards Creator-Led Training

Debt.com’s response to this shift has not been to compete with creators, however to combine them. Based as a shopper platform serving to individuals perceive bank card debt, pupil loans, tax aid, and chapter, the corporate has expanded its position past transactions.

“Our actual mission is to maintain individuals from entering into debt,” Don says. “And in the event that they do, assist them out of it as rapidly and easily as doable.”

To try this, Debt.com more and more capabilities as a hybrid: fintech infrastructure on the core, content material and creator collaboration on the edges. Don describes the corporate in the present day as “a little bit little bit of the whole lot,” technology-driven, however content-led.

“We’re undoubtedly a fintech firm,” he says. “However we’re very a lot a content-driven firm, and we welcome specialists within the trade.”

That features creators who already command belief amongst audiences dealing with monetary stress. Slightly than pushing customers down a single path, Debt.com positions itself as a information, connecting individuals with the proper info, creators, or vetted suppliers, relying on their scenario.

“Within the previous days, they’d say, ‘Simply go get chapter, and also you’ll be advantageous,’” Don says. “It’s not the only option for everyone.”

Photograph: Landing Luncheon 2025

Supply: Debt.com

Why the FinTalk Awards Wanted to Change

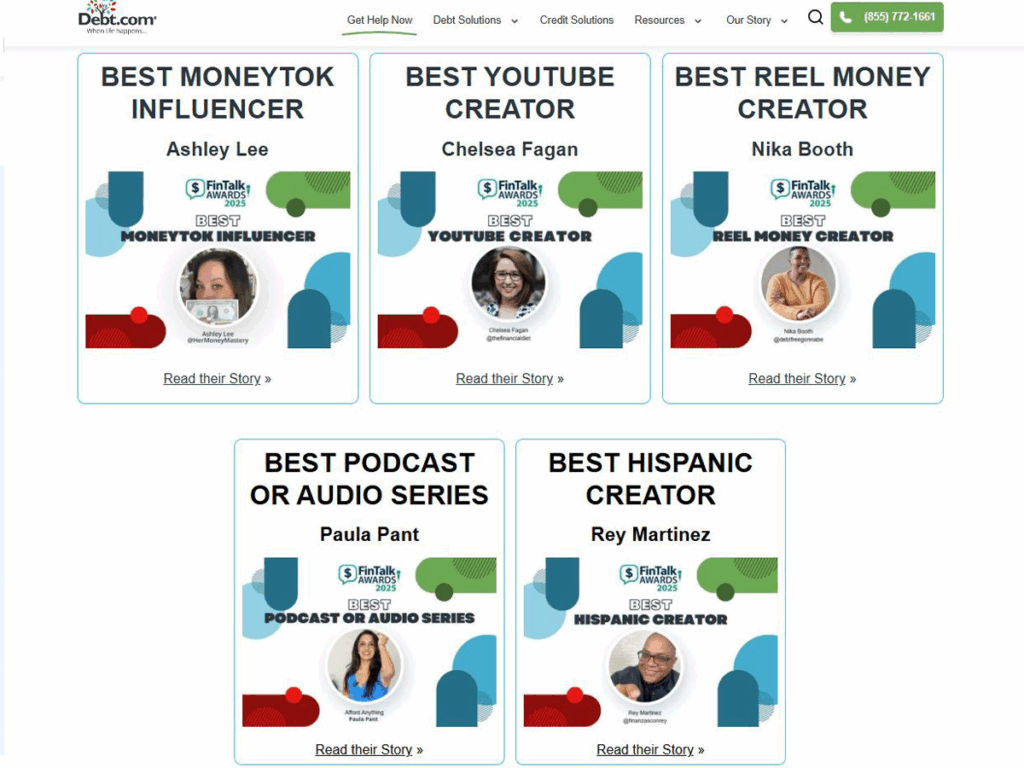

The FinTalk Awards emerged from that very same realization. Initially conceived to highlight monetary creators, notably on TikTok, the awards have been designed to acknowledge high quality quite than reputation.

“It wasn’t about who had essentially the most views,” Don says. “It was whose content material is authentic, who’s doing it for the proper causes, and who’s giving good recommendation.”

Over time, nonetheless, the creator house modified. Monetary training has expanded past short-form video to podcasts, long-form YouTube content material, newsletters, and blogs. For Don, the awards wanted to replicate that shift.

“The world has modified,” Don says. “Social media has modified.”

Reimagining the FinTalk Awards was not about rebranding for novelty’s sake, he stresses. It was about acknowledging how audiences really eat monetary steerage in the present day and the way creators function as companies.

“We needed to diversify the forms of content material we have a good time,” Don says. “There’s actually good things on the market that individuals might not even find out about.”

What the 2025 Awards Revealed About Creator-Led Finance

Reviewing this yr’s nominees, Don says essentially the most putting perception was the depth of expertise.

“There have been so many actually strong contestants,” he says. “It was troublesome to decide on.”

For Don, that abundance displays how normalized creator-led monetary training has change into. Creators are now not fringe voices; they’re main educators for giant audiences, typically crossing borders and cultures.

“These content material suppliers are usually not simply talking to their hometown anymore,” Don says. “It’s going worldwide.”

Equally notable was what didn’t stand out: gimmicks. Don attracts a transparent line between creators who construct belief and people who chase shortcuts. “This isn’t ‘Prime 10 steps,’” he says. “These are actual conditions and actual steerage.”

Creators because the New Monetary Entrance Door

Some of the consequential implications of this shift is the place monetary journeys now start. As Don explains, in lots of situations, the primary touchpoint is just not a financial institution web site or advisor session. It’s a creator.

“Individuals will take the influencer’s recommendation earlier than they’ll return to something conventional,” Don says.

That doesn’t imply creators exchange establishments fully. As a substitute, they act as filters, serving to audiences resolve when and the place to hunt skilled assist.

Debt.com’s position, in Don’s view, is to assist that transition responsibly. “We don’t throw only one resolution,” he says. “We need to perceive your situation.”

In apply, meaning typically directing customers away from providers and towards DIY training or creator content material that higher suits their wants. “Generally we’ll inform any person it’s actually not in your finest curiosity to go to an organization,” Don says. “Right here’s a spot on our web site, or right here’s an influencer that matches you.”

This method reframes monetization as secondary to belief.

Group Over Competitors

In mild of the brand new FinTalk Awards, Don envisions deeper collaboration amongst creators and probably extra bodily community-building.

“Might we ultimately have an actual awards-type factor?” he asks. “A banquet. Bringing individuals collectively.”

That imaginative and prescient displays a broader shift Don sees within the creator financial system: from zero-sum competitors to shared credibility. “It’s not competitors,” he says. “It’s celebrating one another’s success.”

The reimagined FinTalk Awards are much less about trophies and extra about signaling legitimacy. For creators, this validation affirms that monetary training isn’t just leisure or facet revenue, however a severe enterprise class with actual influence.

In a monetary house formed by uncertainty, Don believes that collective belief might show extra sturdy than any establishment alone. “Go to the content material that resonates with you,” he advises. “However in case you ever get caught, there are individuals who might help information you.”

Elevate your perspective with NextTech Information, the place innovation meets perception.

Uncover the newest breakthroughs, get unique updates, and join with a worldwide community of future-focused thinkers.

Unlock tomorrow’s developments in the present day: learn extra, subscribe to our publication, and change into a part of the NextTech neighborhood at NextTech-news.com