Disclaimer: Except in any other case acknowledged, any opinions expressed under belong solely to the creator.

The HDB Resale Value Index has hit over 200 factors for the primary time ever in Q1 2025, as rising costs within the resale market proceed to be a significant matter in Singapore.

Cumulatively, they’ve elevated by over 50% since 2020, inflicting a lot alarm not solely amongst Singaporeans however the authorities as nicely.

And but, regardless of all of the complaints and cooling measures, inflation within the housing market continues unabated. However why?

If all people is complaining, then why are Singaporeans nonetheless paying?

Public housing in Singapore continues to be inexpensive

Everyone appears to be upset concerning the continued inflation, however these perceptions are warped by the lengthy interval of stagnation within the HDB market, which made residences comparatively cheaper vs. rising incomes.

For six years between 2014 and 2020, the costs remained comparatively flat, if not trending barely downward.

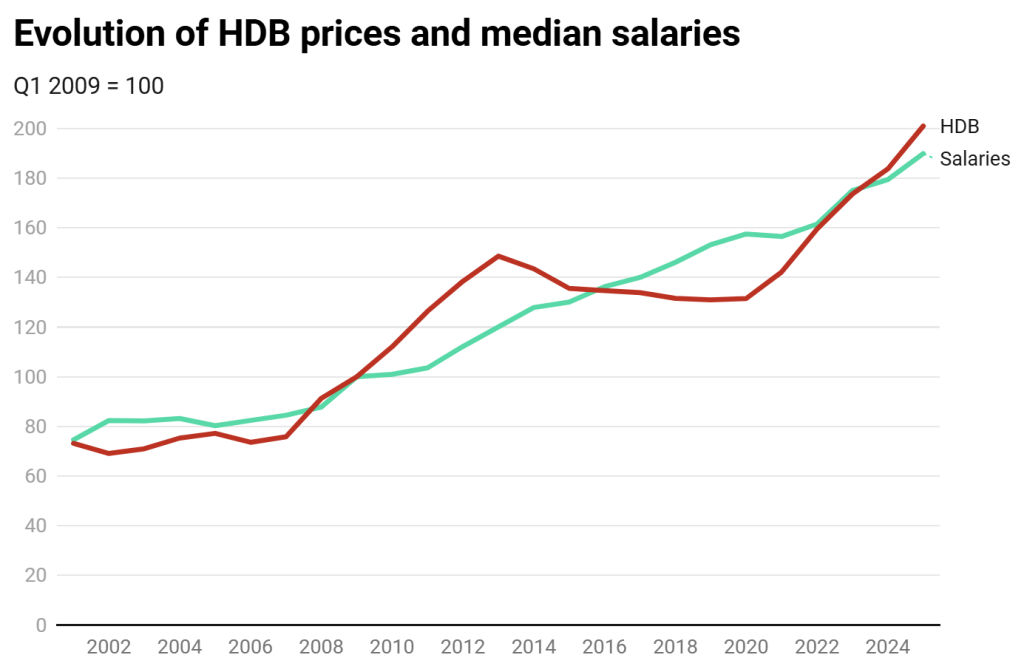

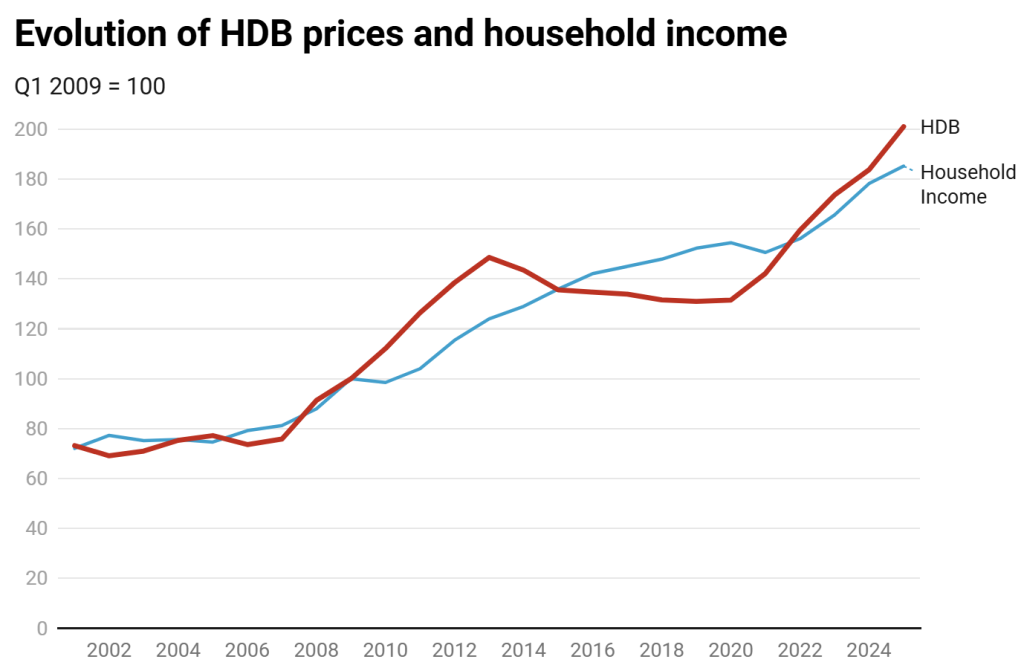

Nevertheless, while you examine them, for instance, to the bottom 12 months in 2009, when the index learn 100 factors— so, half of what it’s at present—native incomes additionally have been about half of what Singaporeans are paid now.

The median gross month-to-month earnings of Singapore residents has elevated by 90% between 2009 and 2025. In the meantime, resale HDB costs have gone up by 96% (from This autumn of 2008 to This autumn of 2024)

Median family earnings is at present lagging a number of proportion factors behind, having grown by 85% to 96% for resale housing—nevertheless it’s nonetheless a far cry from the 24.6 level distinction recorded in 2013, earlier than authorities measures put a lid on inflation and froze the marketplace for a number of years.

The swings in both the incomes outpacing HDB costs or the opposite method round reached round 20 to 25% in 2013 and 2020.

This implies that Singaporeans should exhibit an urge for food for getting at rising costs for the following few years, earlier than the present gaps may multiply in measurement and change into untenable, or the federal government enacts new measures to sluggish them down.

Costs to sluggish in 2025, however would possibly nonetheless develop quickly

Following the 1.6% bump in Q1 of 2025, property analysts are anticipating annual development of between 3 to eight%—decrease than 9.6% reported in 2024 however nonetheless excessive (and far increased than shopper inflation, which has at present dropped underneath 1%).

With salaries anticipated to obtain a lift by round 3 to 4%, this is able to proceed to increase the hole between incomes and HDB costs.

Nevertheless, even underneath excessive situations, assuming continued 8% development in HDB costs and round 3% enhance in median salaries, it might take three to 4 years for us to reach at the place we have been in 2013.

That is an indicator of tolerance for monetary ache that Singaporeans needed to settle for 12 years in the past, exhibiting that demand for resale HDBs just isn’t prone to drop organically anytime quickly with out even stricter authorities intervention, a major enhance to produce, or a rebound in mortgage charges making borrowing costlier (because it was one of many drivers of demand after the monetary disaster of 2008/09, which triggered a world slide in rates of interest).

Chee Hong Tat, the brand new Minister for Nationwide Growth, is anticipating a moderation in costs from 2026 onwards when resale provide is predicted to obtain a lift and when the residences constructed after the pandemic delays start reaching their MOP interval.

I imagine this case will enhance, and we’ll see a moderation of resale flat costs when extra of the brand new flats that we’ve got in-built the previous couple of years attain the five-year minimal occupation interval ranging from 2026. As soon as we see extra provide coming in, and likewise coupled with extra new BTO flats getting into the market, I feel we’ll see moderation within the resale flat costs within the years forward.

Chee Hong Tat

The reality is that Singaporeans are shopping for as a result of they will.

Regardless of continued complaints, incomes are growing, mortgage charges have moderated (making low cost financing broadly out there), whereas ever youthful, extra fashionable residences are getting into the market, changing into a contest not solely to older housing however to non-public condominiums.

Even with regulatory obstacles aiming to sluggish the demand down, the reality is that purchasing an HDB condominium stays each low cost and straightforward.

And with hybrid work preparations, permitting hundreds of individuals to spend a part of their time working from residence, area has now change into an funding in improved livelihood—that Singaporeans are each prepared and in a position to pay for.

- Learn different articles we’ve written on Singapore’s present affairs right here.

Featured Picture Credit score: Muhd Asyraaf / Unsplash