KeepAm, a Nigeria-based tax file and submitting app launched in January, is constructed for distant employees, creators, and small operators who’ve traditionally earned first and considered tax later.

As a substitute of a as soon as‑a‑12 months tax chore, the app reframes as one thing customers quietly sustain with via on a regular basis file‑preserving.

Its founder, Emmanuel Oshola, frames the product round two linked concepts: many new earners now fall underneath tax guidelines they don’t perceive, and plenty of additionally miss deductions that would cut back what they owe in the event that they stored correct information. The app, out there on the net and usable offline, is constructed to handle this.

Massive elements of financial exercise in Nigeria sit outdoors payroll programs, the place tax is deducted routinely. Coverage, nevertheless, is shifting towards better knowledge visibility. As an illustration, Nigerian banks already report transaction knowledge underneath monetary surveillance guidelines. The Federal Inland Income Service has pushed e-filing programs alongside nearer monitoring of digital and cross-border revenue. Platforms like KeepAm sit between uncooked financial institution transactions and formal tax filings, translating one into the opposite.

Turning financial institution inflows into tax information

KeepAm’s design relies on a sensible drawback that defines fashionable tax enforcement in digital economies. When cash lands in a checking account, authorities can see the quantity and the account holder, however can’t decide whether or not the switch represents revenue, reimbursed bills, a pass-through cost to suppliers, or a private reward.

In an open banking system that depends on buyer knowledge, the default threat for organised freelancers is that gross inflows start to resemble taxable revenue, Oshola explains, except the person can show in any other case.

Oshola describes this burden of proof as central to the product’s design, arguing that with out structured information, individuals who work undertaking to undertaking could also be assessed on turnover moderately than precise earnings after prices.

KeepAm responds by constructing a steady documentation layer over on a regular basis transactions.

Signing up

The product follows a easy and intuitive movement. Customers begin by signing up and logging revenue every time they’re paid. Subsequent, they connect associated bills and retailer corresponding proof or receipts in a single place.

From there, customers can generate an in depth report every time they want it. This course of continues all year long, making it simpler to remain organised moderately than speeding to compile information throughout submitting season.

“We use multi-layer validation with Nigerian-specific patterns,” Oshola. “Widespread points embrace blended currencies (we auto-convert to NGN), money transactions (we permit with confidence scoring), and casual descriptions.”

Customers log revenue because it is available in and are prompted to connect associated bills, starting from knowledge purchases and transport to software program subscriptions and tools.

The system asks whether or not prices had been incurred to ship a selected job, then classifies these gadgets as potential deductions.

Receipts, whether or not paper or digital, could be captured and saved throughout the app, turning what would possibly in any other case be misplaced or casual proof right into a retrievable archive.

In response to Oshola, this construction feeds into the submitting report that customers can obtain and undergo their state tax authority.

The product additionally incorporates digital invoicing, which aligns with broader authorities curiosity in traceable billing.

As a substitute of sending purchasers solely an account quantity, customers can challenge invoices via the app, linking cost requests to documented work.

As soon as paid, the bill, cost and associated bills sit inside a single chain of information. For creators and freelancers accustomed to casual workflows by way of messaging apps, this represents a shift towards formal bookkeeping with out the necessity to undertake full accounting software program, which many discover too complicated or costly.

Oshola mentioned the purpose is to not flip people into accountants, however to embed tax-relevant construction into actions they already take.

That design alternative issues as a result of the platform intentionally avoids accounting jargon.

Utilizing KeepAm

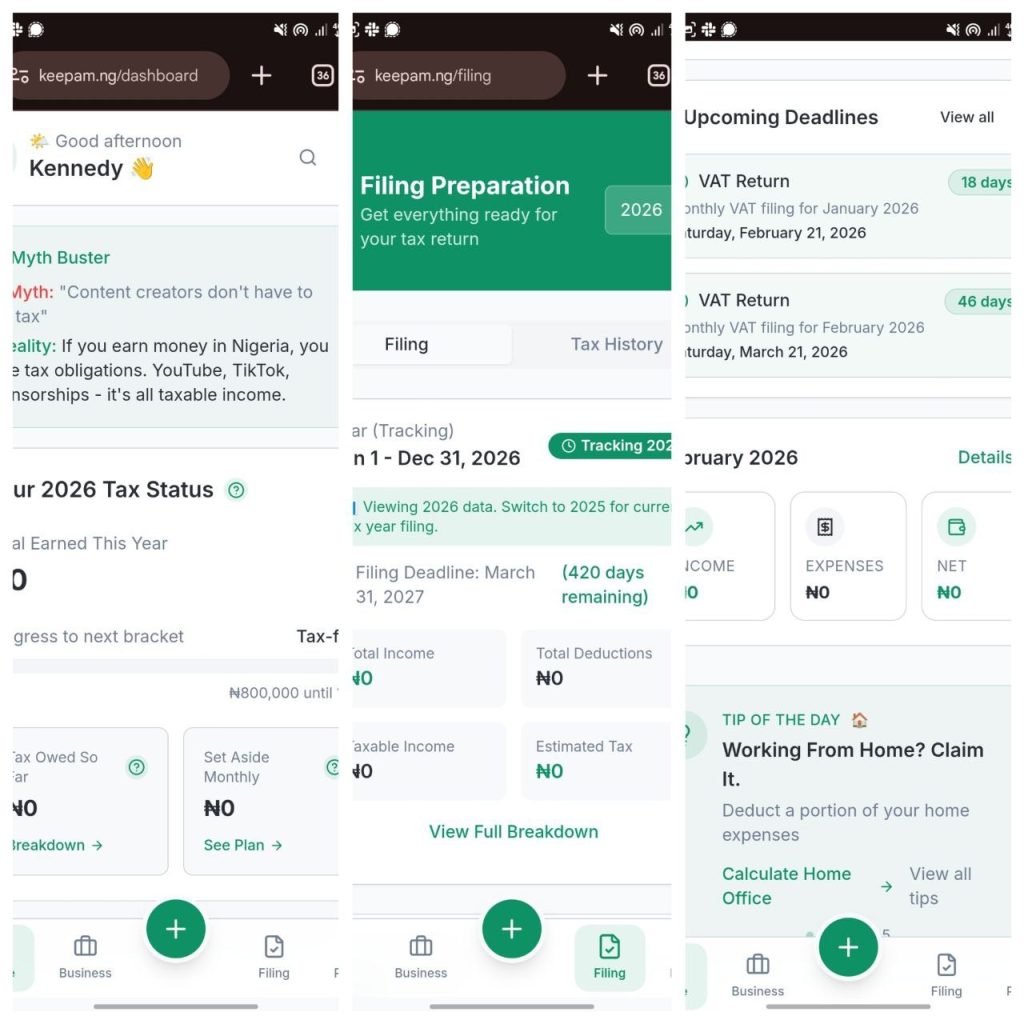

Signing up for KeepAm took lower than three minutes, with instantaneous electronic mail verification and a dashboard that loaded in about two seconds on my gadget. The primary display screen provides a transparent overview of a consumer’s funds, exhibiting revenue, bills, internet place for the month, and tax standing for the 12 months in a single place.

The dashboard highlights sensible instruments throughout the highest, together with Calculate, Tax Plan, Shoppers, Projections, Invoices, and Financial savings, permitting customers leap straight into core tax and enterprise duties with out digging via menus. Every part opens right into a centered workspace, comparable to monitoring revenue and bills, managing receipts, or dealing with purchasers and enterprise profiles.

Upcoming tax and value-added tax (VAT) deadlines are displayed in a devoted panel, with due dates and countdowns in days, making it simpler to remain compliant moderately than counting on reminiscence or separate reminders. A “Tip of the Day” card surfaces context-aware steering, comparable to the way to declare residence workplace deductions, with fast hyperlinks to launch a related calculator or view extra ideas.

The tax standing module exhibits whole earned this 12 months, progress towards the following tax bracket, tax owed to this point and the way a lot to put aside month-to-month, with hyperlinks to view an in depth breakdown or plan. Delusion‑buster banners on the prime handle widespread fears about taxes and compliance in plain language, serving to customers really feel extra assured about beginning to file, even when they haven’t been paying frequently.

Automation

KeepAm positions itself as an automatic system moderately than a human advisory service. Oshola clarified that calculations and classifications are run via the software program, with restricted back-end visibility into consumer knowledge and no logging of administrative entry, reflecting compliance with Nigeria’s knowledge safety framework.

This structure issues as a result of goal customers are being requested to centralise delicate monetary info in a single place, together with revenue information and tax identifiers.

There’s a free primary account that features as much as 20 bill checks, 20 revenue and expense entries, and 20 receipt scans. The professional model prices ₦2,500 ($1.79) and offers entry to invoicing, expense monitoring, and tax submitting instruments. The enterprise model prices ₦7,500 ($5.37) and contains all professional options, plus full enterprise instruments designed for SMEs.

For a inhabitants that usually mistrusts authorities and digital platforms, perceived knowledge threat could be as important as tax threat.

Automation right here doesn’t take away consumer duty. The platform information behaviour: if a consumer misclassifies a private switch as enterprise revenue, the software program doesn’t block it; as an alternative, it preserves the file path to enhance documentation.

App works offline

I examined KeepAm whereas in Kenya, which mirrors what number of of its goal customers work throughout borders for international purchasers. The service runs as an online app, and as soon as customers join via the location, they will add it to their residence display screen like an everyday app with out going via an app retailer.

The offline mode stands out as a result of you’ll be able to enter revenue, log bills, and scan receipts with out an lively connection, with knowledge syncs later.

In a market the place cellular knowledge is pricey and connectivity is uneven, this helps constant record-keeping moderately than delayed bulk entry. From a tax perspective, that timing issues as a result of deductions are simpler to defend when logged near when the associated fee occurred, not reconstructed months later from reminiscence.

Points with automation

Automation helps, however it doesn’t get rid of structural complexity: private revenue tax in Nigeria is run on the state stage, with every state working its personal submitting course of layered on federal guidelines.

Compliance

The pricing mannequin displays the breadth of the supposed viewers. The free tier limits apply to invoices, however it makes the product straightforward to attempt with out committing upfront.

The paid plan removes these caps and permits checking account linking by way of open banking, permitting transactions to be pulled in and sorted with much less handbook work. The upper-tier targets small companies that want payroll instruments and payslip technology, shifting the product past solo freelancers right into a broader enterprise context.

General, this construction aligns with coverage efforts to broaden the tax base. If extra freelancers, creators, and distant employees maintain organised information, tax shifts from a obscure menace to a set of numbers tied to documented revenue.

This mirrors what payroll software program did for salaried employees many years in the past. Compliance shifted from an annual calculation to an automated course of embedded in every day work. Apps like KeepAm try the identical shift for the self-employed.

Instruments like this solely matter if customers deal with tax monitoring as a part of on a regular basis work, moderately than a last-minute scramble close to deadlines, which stays widespread in markets like Kenya.

Regardless of testing the app outdoors Nigeria with two colleagues, I famous that it was constructed round expense prompts that seem on the proper second. The platform additionally compiles every day entries into reviews that operate as tax information.

“We generate PDF reviews with distinctive IDs, bracket breakdowns, and timestamps,” Oshola concluded.

Elevate your perspective with NextTech Information, the place innovation meets perception.

Uncover the newest breakthroughs, get unique updates, and join with a world community of future-focused thinkers.

Unlock tomorrow’s developments immediately: learn extra, subscribe to our e-newsletter, and turn out to be a part of the NextTech group at NextTech-news.com