Sandbox Community, certainly one of Korea’s largest creator platforms, is shifting towards a 2026 KOSDAQ itemizing after almost a decade of evolving its MCN enterprise mannequin towards IP and digital leisure. Its IPO submitting isn’t just a monetary occasion — it displays the structural evolution of Korea’s creator financial system, the place profitability now depends upon IP possession and platform independence fairly than advert income alone.

Sandbox Community’s KOSDAQ Bid Positive aspects Momentum

Based on Seoul Financial Every day, Newsis, and Cash At present, Sandbox Community formally appointed Korea Funding & Securities as its lead underwriter and can pursue a KOSDAQ IPO in 2026.

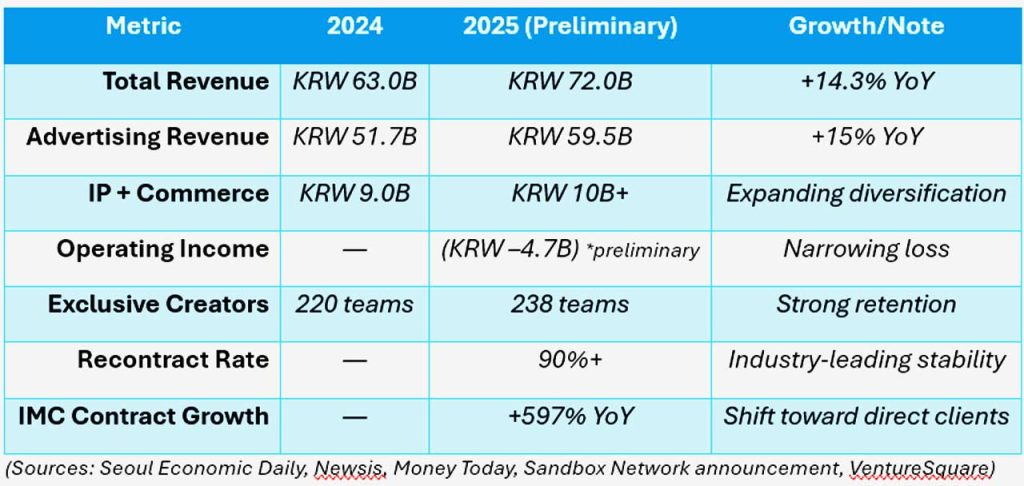

The corporate, co-founded by creator Na Hee-sun (Ddotty), posted KRW 72 billion (USD 54 million) in standalone income for 2025 — a 14% enhance year-on-year.

Promoting stays its major income stream at KRW 59.5 billion, up almost 15%, whereas IP and commerce companies collectively surpassed KRW 10 billion. Regardless of this progress, Sandbox recorded an working lack of KRW 4.7 billion (2025 preliminary), highlighting the profitability problem nonetheless dealing with Korea’s MCN (multi-channel community) sector.

The corporate helps 1,139 promoting creator channels and 238 unique creator groups, boasting an common six-year contract time period and a renewal charge above 90%, knowledge constant throughout a number of native media stories.

Why This IPO Issues Past the Numbers

Sandbox’s IPO just isn’t merely a capital-raising occasion. It symbolizes Korea’s try and show that its creator financial system can evolve from ad-driven administration to mental property–primarily based digital leisure.

The pivot started in 2022 when CEO Lee Pil-seong reframed Sandbox as a digital leisure firm, emphasizing IP growth over conventional MCN operations. In an interview with VentureSquare, he described the MCN trade as “coming into its early maturity section,” the place survival depends upon distinctive IP, sustainable creator fashions, and cross-media monetization.

In 2024, Sandbox consolidated management underneath a single-CEO construction led by Cha Byeong-gon, positioning itself for “clear and environment friendly decision-making” forward of the IPO, in accordance with the corporate’s personal assertion.

Sandbox’s IPO additionally aligns with a broader recalibration in Korea’s KOSDAQ market. In early 2026, Seoul Robotics withdrew its itemizing bid underneath tighter income standards, whereas Pinkfong Firm’s late-2025 IPO proved that IP-based content material can meet profitability requirements.

Collectively, they present that Sandbox now enters a extra disciplined public market—one which rewards monetized creativity and penalizes unsustainable scale.

Inside Sandbox Community Korea’s Enterprise Transformation

Sandbox’s progress drivers reveal an organization consciously shifting away from the low-margin MCN entice:

The corporate’s IMC (Built-in Advertising Communication) enterprise achieved 597% progress in annual contract worth, with direct offers rising to 69% of income. Main promoting purchasers now embrace Roborock, Epic Video games, Nexon, and Amorepacific, in accordance with stories from Cash At present.

The IP arm additionally noticed sturdy momentum: Sandbox’s publishing division surpassed 2.79 million cumulative copies offered, turning characters like Baek & A, Purple Pajama Yako, and Ddushik into high-performing artistic IPs. These IPs are monetized by publishing, merchandise, performances, licensing, and different spinoff codecs.

Sandbox Community Korea’s Company Route

“Our clients are creators. Demonstrating belief and long-term partnership is our core enterprise philosophy,”

— Lee Pil-seong, Sandbox Community CEO, VentureSquare (April 2025)

“We goal to evolve past MCN operations to guide as a digital creator IP platform,”

— Sandbox spokesperson, Seoul Financial Every day (Jan 2026)

Lee emphasised that IP-driven diversification is not elective:

“Promoting-based buildings face clear limits. By quickly shifting towards IP enterprise, we expanded our scope successfully.”

Korea’s Creator Market at a Turning Level

Based on a 2024 report from Korea’s Ministry of Science and ICT, the digital creator media trade reached KRW 5.31 trillion in 2023, up 28.9% year-on-year. Inside that, the MCN and administration section accounted for KRW 753.1 billion, illustrating each the market’s growth and its rising professionalization.

But conventional promoting income is tightening. The KDI Financial Info Heart recorded a 7.4% decline in Korea’s broadcast promoting income in 2024. Trade analysts believed that this development reinforces the shift towards diversified creator monetization by IP and commerce.

Sandbox’s pivot displays this broader structural development. Whereas smaller MCNs battle with platform dependency and unstable advert markets, Sandbox is constructing hybrid fashions throughout youngsters content material, gaming subculture, and digital IP ecosystems, tapping into resilient fan communities and multi-format licensing.

What Sandbox’s IPO Actually Exams

Sandbox’s IPO is much less a monetary check than a proof of scalability for Korea’s post-MCN mannequin. It should exhibit that creator networks can evolve into IP ecosystems that maintain profitability even underneath declining advert CPMs and algorithmic volatility.

Excessive creator retention and speedy IMC progress level to operational power, however in addition they expose Sandbox’s core problem: engagement scales sooner than margin. Till IP-derived income persistently outpaces MCN administration prices, profitability will stay structurally constrained.

Not like PowerCubeSemi’s forthcoming technology-special itemizing or Pinkfong’s confirmed leisure export mannequin, Sandbox should persuade buyers that creator-economy IPs may be as scalable—and defensible—as industrial or cultural ones. The comparability underscores how Korea’s 2026 IPO pipeline now assessments three worth theses directly: technological credibility, cultural IP scalability, and digital-platform sustainability.

The KOSDAQ route, identified for its flexibility towards growth-stage tech companies, is noticed to present Sandbox room to cost its itemizing primarily based on progress potential fairly than legacy earnings. Nevertheless, the last word measure shall be whether or not Sandbox can maintain constant profitability — one thing CEO Lee himself recognized because the 2025 milestone.

Evaluation: Why Sandbox’s IPO Is a Stress Take a look at for Korea’s Creator Economic system

Sandbox’s deliberate itemizing isn’t just about capital entry. It assessments whether or not Korea’s creator platforms can escape the structural limits of MCN economics.

There are three unresolved questions outline this IPO:

- Can IP offset MCN margin stress quick sufficient?

Regardless of sturdy income progress, Sandbox stays loss-making. The important thing threat is whether or not IP and digital items can scale margins sooner than creator administration prices. - Is IMC progress structurally recurring or campaign-driven?

The 597% surge in IMC contracts displays sturdy consumer demand, however buyers will scrutinize how a lot of this progress is repeatable versus event-based. - Does creator IP provide defensibility similar to conventional content material IP?

Not like animation or gaming IP, creator-led IP faces sooner viewers churn and platform dependence — a threat KOSDAQ buyers are actually being requested to cost.

Sandbox’s IPO subsequently represents a broader market check, whether or not Korea’s creator financial system can mature from scale-driven progress into margin-driven sustainability.

Getting into Capital Market Period — A Pivotal Milestone

Sandbox’s deliberate IPO marks a pivotal second for Korea’s digital creator financial system. If profitable, it may probably set a brand new precedent for MCN-to-IP transformation, signaling that Korea’s creator enterprises can transfer past algorithmic survival towards value-based scalability.

As advert CPMs compress and platform algorithms stay unstable, Sandbox’s IP technique represents certainly one of Korea’s first actual makes an attempt to cost creator companies as long-term belongings fairly than short-term visitors managers.

Key Takeaways on Sandbox Community KOSDAQ IPO 2026

- Sandbox Community targets a 2026 KOSDAQ IPO after posting KRW 72B in 2025 income (+14% YoY).

- The corporate’s preliminary working lack of KRW 4.7B in 2025 underscores persistent MCN margin stress.

- Transitioning from ad-driven MCN to IP-based digital leisure, Sandbox now scales publishing, licensing, and digital IP.

- IMC contracts grew 597%, with direct purchasers (69%) bettering profitability.

- Korea’s creator media trade reached KRW 5.31T in 2023, whereas broadcast promoting fell 7.4%, accelerating structural shifts towards creator-led IP.

- Sandbox’s IPO will check whether or not creator-led IP can ship defensible margins, not simply viewers scale, underneath KOSDAQ’s tightening profitability expectations

– Keep Forward in Korea’s Startup Scene –

Get real-time insights, funding updates, and coverage shifts shaping Korea’s innovation ecosystem.

➡️ Comply with KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Fb, and WhatsApp Channel.

Elevate your perspective with NextTech Information, the place innovation meets perception.

Uncover the most recent breakthroughs, get unique updates, and join with a worldwide community of future-focused thinkers.

Unlock tomorrow’s tendencies at the moment: learn extra, subscribe to our publication, and turn out to be a part of the NextTech neighborhood at NextTech-news.com