Nigeria is an financial system primarily pushed by money, with a restricted vary of credit score amenities. And with this comes questions on the way to generate, construct, and maintain wealth, investments being certainly one of them. Nonetheless, there isn’t a single path to investing, and the choices are huge. Similar to mutual funds, mounted revenue securities, Trade Traded Funds (ETFs), and so forth.

“Newbies normally begin with the objective to change into financially free and unbiased, however they don’t break it all the way down to what it means for them,” mentioned Tijesunimi Oresanya, Supervisor, Resolution Structure (CEMEA) at Visa. “They need to outline their objectives from the beginning. For instance, I need to make investments long-term or short-term. This can decide your threat tolerance and the kind of investments acceptable for you.”

For these contemplating completely different funding devices and funding platforms, Oresanya highlights the necessity to concentrate to the small print, particularly the brokerage charges: “Generally investments include some charges. The platform brokering for it’s possible you’ll require a proportion for his or her service; novices normally don’t issue this in when analysing a possibility. A 1% price over a very long time may be very vital.”

What are some Nigerian funding platforms?

From conversations with monetary advisors to suggestions from long-standing customers, I pooled a listing of apps you may discover if you’re contemplating investing within the Nigerian inventory market. So, whether or not you go for a digital wealth supervisor or brokerage apps by means of which you’ll start buying and selling instantly, listed below are a number of you may think about in no explicit order.

1. Bamboo

Bamboo gives alternatives to speculate and coaching assets for novices and seasoned traders in search of to be taught in regards to the funding panorama. With 3.5k+ shares to select from and over 500,000 customers, the app leverages AI-driven market insights to alert customers on funding alternatives.

The funding app additionally means that you can start buying and selling with zero paperwork, requiring solely your contact particulars and Nationwide Identification Quantity (NIN). With Bamboo, you may commerce shares and ETFs, make investments instantly in Nigerian and US shares, and handle your investments, all throughout the app. Its mounted revenue permits for as much as 8% annual returns in USD and as much as 21.4% annual returns on Naira financial savings.

The funding app gives the choice to speculate with low minimums, beginning as little as $1. Bamboo’s cell app is out there to obtain on the App Retailer and the Play Retailer.

TL;DR: Put money into U.S and Nigerian shares

- No Paperwork, simply your NIN and phone particulars

- Make investments with as little as $1

2. Risevest

Risevest means that you can make dollar-dominated investments in International and U.S markets, together with U.S actual property. These investments can yield returns starting from 8% to fifteen%.

Nonetheless, Rise is just not a brokerage app, however capabilities as a digital wealth or asset supervisor. It doesn’t provide direct buying and selling. However somewhat curates and presents portfolios in US shares, US actual property, and world mounted revenue property, to steadiness threat and reward, whilst you select how a lot you need to make investments.

Together with curating the shares with long-term payoffs, Rise has funding consultants and professionals to handle these investments on behalf of customers. In comparison with different platforms, Risevest. Risevest and its subsidiary, Chaka, accumulate a buyer base of 620,000 customers. The app is accessible in your smartphone on the Play Retailer or App Retailer.

TL;DR: Put money into dollar-denominated property

- Customers can not commerce instantly, however have their property managed by Risevest consultants

- Put money into US shares, actual property, or world mounted revenue portfolios

3. Trove

Together with offering a platform to put money into over 4,000 US and Nigerian property, Trove additionally gives studying assets by means of its product, Trove College, the place you may study investing and earn factors. You’ll be able to then use your factors to redeem rewards equivalent to airtime or knowledge, and buying and selling price credit.

Via microinvesting, Trove additionally means that you can present shares to others, equivalent to household and family members. Via leveraging the neighborhood, the app permits for social investing, the place you may join with pals throughout the app and discover different traders’ holdings. Trove reveals breakdowns of others’ funding portfolios, together with their bonds, shares, and monitor information. The app has no minimal funding quantity, and yields as much as 20% annual returns on Nigerian financial savings and 5.5% on U.S. greenback financial savings.

The app aggregates a buyer base of over 400,000 registered customers. Trove is out there as a cell app on the App Retailer and the Play Retailer.

TL;DR: Social investing instruments to attach with pals and seasoned traders

- Provides funding training for customers to earn factors and redeem rewards

- Permits low minimums to speculate with as little as $1

4. Piggyvest

Initially a financial savings app, Piggyvest presents an array of funding choices inside a 6-12 month timeframe, and as much as 35% returns. With their product, Investify, you may buy ‘Company Debt Notes’, backed by corporations with as little as ₦5,000. Or you should purchase ‘Sovereign Debt Notes’, backed by the federal government, with about ₦12,000 to ₦ 19,000, and are quick to medium time period. Piggyvest additionally gives pre-vetted alternatives to put money into actual property, agriculture, and even transportation.

Nonetheless, a few of these alternatives can be found periodically and promote out shortly, so you’ll have to be looking out. Practically 6 million folks have used the app’s financial savings and investing platform. You’ll be able to make investments by means of the online app or the cell app obtainable on the App Retailer or the Play Retailer.

TL;DR: Can make investments with as little as ₦5,000

- Investments are inside a 6-12 month timeframe

- Pre-vetted alternatives in actual property, agriculture, and transportation

5. Optimus by Afrinvest

Via Afrinvest Asset Administration Restricted, a portfolio supervisor licensed by the SEC, you may put money into US and Nigerian shares, mutual funds, mounted deposits, and different high-yield choices. With Optimus by Afrinvest, you may put money into Nigerian shares and treasury payments.

Optimus by Afrinvest gives funding banking, asset administration, and consulting companies. The app additionally gives a wide range of mutual funds, such because the Afrinvest Halal Fund, that are Shariah-compliant. Then the Afrinvest Plutus Fund, which you’ll put money into with as little as 5,000, and the Afrinvest Greenback Fund for brief to medium investments for greenback flows. The funding app additionally creates a provision for financial savings, multi functional place. Optimus has a provision so that you can make investments with ₦1,000 or much less and is out there on the App Retailer or the Play Retailer.

TL;DR: – Put money into Nigerian shares and treasury payments with ₦1,000 or much less.

- Contains distinctive mutual funds like Afrinvest Halal Fund (Shariah-compliant), and Afrinvest Greenback Fund for dollar-denominated investments.

- Financial savings options & funding choices, in a single safe platform.

6. MERITRADE by Meristem

Meristem means that you can be your individual dealer by means of its on-line stockbroking platform, MERITRADE. That’s, you should buy and promote your shares instantly. You’ll be able to create an account to purchase shares for your self, or a custodial account for a minor. Meritrade means that you can monitor shares bought earlier and offers technical and elementary recommendation on inventory suggestions.

As of February 2025, the Meristem Fairness Market Fund had over ₦1 billion in property, highlighting sturdy investor confidence. The app gives Margin Buying and selling, enabling traders to borrow funds towards their present holdings. New traders can entry a margin mortgage for as much as ₦3million, and current customers can take a mortgage for as much as ₦5million. Meritrade additionally gives fundamental funding programs and is out there on the App Retailer or the Play Retailer.

TL;DR: Allow traders to borrow towards their present holdings to buy shares

- Permits monitoring of shares bought way back

- Can purchase and promote shares for minors

Customers additionally diversify their investments to steadiness threat and rewards. One long-term funding app person, Lydia Oke, mentioned, “What I’m trying to obtain with Naira funding is completely different from what I’m trying to obtain with greenback investments.”

On the time of this text, she selected a number of funding platforms: Meristem for Naira investments, Bamboo for her greenback investments, and Stanbic for mutual funds, to have a various portfolio with respective strengths.

How will you put money into the Nigerian inventory market?

To put money into the Nigerian inventory market, you’ll want to open a brokerage account. You are able to do so by means of brokerage homes equivalent to Afrinvest, CSL by FCMB, FBNQuest, and Stanbic IBTC. You can even arrange a brokerage account out of your cell system by means of Funding apps equivalent to Bamboo or Piggyvest. Listed below are the paperwork normally required to arrange your dealer account:

- A Nigerian checking account

- Your Financial institution Verification Quantity (BVN)

- A passport {photograph}

- A legitimate technique of identification. This could possibly be your driving licence, a global passport, or a Nationwide Identification Card.

- Utility invoice for proof of tackle.

After creating your dealer account, you acquire a Central Securities Clearing System (CSCS) account to put money into the Nigerian inventory market. Your brokerage home will create the CSCS account 24 to 48 hours after your paperwork are verified. Your CSCS account is the digital storage location on your shares and share certificates. After buying your CSCS account, fund it by means of your Nigerian account, and you’ll start buying and selling. You’ll be able to both commerce by means of brokerage homes or brokerage apps.

The inventory market has working hours, that are timeframes to commerce. The Nigerian inventory market opens by 9:30 am, and buying and selling runs until 2:30 pm.

What funding are you able to begin with ₦10,000?

You should purchase one unit of company debt notes on PiggyVest for as little as ₦5,000, and a couple of unit for those who select. Risevest additionally means that you can put money into world markets with a minimal quantity of $10 (₦14,909.77). You can even put money into Bamboo’s mounted revenue merchandise with as little as $1 and earn a 7.5% dollar-denominated curiosity.

How will you make ₦1,000 a month investing?

With a hard and fast deposit funding plan, you may work out an association together with your financial institution to obtain month-to-month returns in your funding, as a substitute of rolling it over to the following month. Nonetheless, rolling your curiosity to the following month permits your deposit to compound and pay in the long term.

How will you make investments with ₦100?

Optimus by Afrinvest means that you can make investments as little as ₦100 in mutual funds from their cell utility. Risevest and Trove assist you to microinvest and buy fractions of shares with as little as $1 (₦1490.98).

*Trade charges had been calculated at ₦1490.98 is to $1. Please observe, respective funding apps have their very own alternate charges.

TechCabal is just not a monetary recommendation platform. Readers are inspired to independently consider all dangers and seek the advice of with certified monetary, authorized, and tax professionals earlier than making any funding selections.

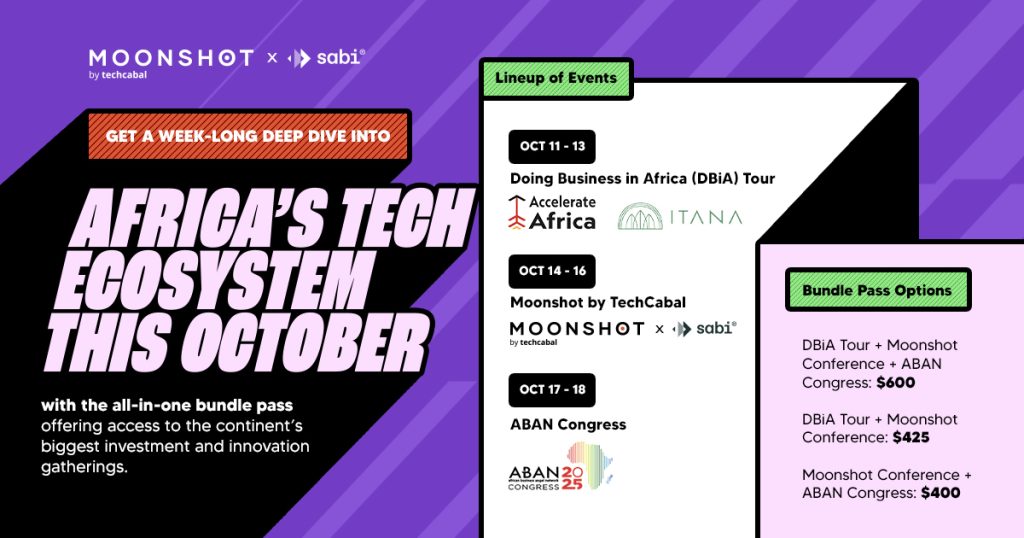

Mark your calendars! Moonshot by TechCabal is again in Lagos on October 15–16! Meet and be taught from Africa’s high founders, creatives & tech leaders for two days of keynotes, mixers & future-forward concepts. Get your tickets now: moonshot.techcabal.com

Elevate your perspective with NextTech Information, the place innovation meets perception.

Uncover the newest breakthroughs, get unique updates, and join with a worldwide community of future-focused thinkers.

Unlock tomorrow’s developments in the present day: learn extra, subscribe to our publication, and change into a part of the NextTech neighborhood at NextTech-news.com