A KRW stablecoin story often will get filed underneath regulation, then forgotten. However this one is completely different. Wemade is attempting to resolve a narrower, more durable downside: methods to construct a blockchain that may survive Korea’s compliance expectations with out forcing monetary customers to place each transaction in public view. That design selection comes with a price, and the trade-off is the purpose.

Wemade StableNet: KRW Stablecoin Infrastructure for Korean Compliance

On January 30, Wemade stated it opened the testnet for StableNet, its KRW stablecoin-focused community, describing it as an infrastructure layer optimized for stablecoin issuance and operations fairly than a general-purpose public chain.

Reviews from Yonhap and Newsis describe a number of technical claims connected to the testnet launch:

- No separate fuel token: transaction charges are designed to be paid utilizing the KRW stablecoin itself, focusing on accounting simplicity and operational predictability for enterprise and monetary companions.

- Quick finality and throughput: StableNet makes use of an in-house consensus method described as WBFT, with claims of sub-second transaction finality and capability as much as 3,000 transactions per second.

- Privateness with audit-readiness: a “secret account” implementation primarily based on ERC-5564 is introduced as a technique to preserve delicate transaction particulars personal whereas nonetheless supporting audit responses when required.

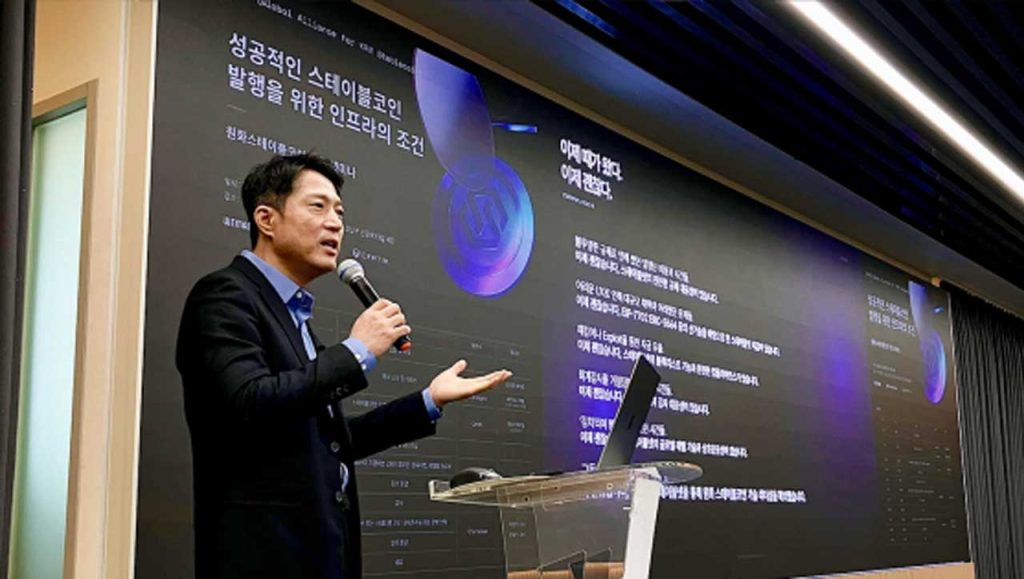

At a Seoul seminar on January 29, Kim Seok-hwan, a vice chairman at Wemade, framed the core purpose bluntly: StableNet is designed in order that “the Financial institution of Korea can really feel comfy,” emphasizing that the community was constructed on the premise of complying with Korean monetary guidelines and adapting to future necessities.

Korean Stablecoin Chain: Why It Issues Now for On-Chain Finance

The extra necessary sign shouldn’t be “one other testnet.” It’s the argument behind it.

Throughout Newsis and Bizwatch’s protection, the corporate’s logic lies in the truth that if stablecoins are meant for use by establishments, the infrastructure should behave like monetary rails, not like a retail crypto community that tolerates probabilistic settlement, risky payment belongings, and ambiguous accountability.

Kim’s critique facilities on a well-recognized public-chain edge case that conventional finance hates: chain reorganization, the place blocks that seemed ultimate might be changed by an extended chain. He additional defined that this can be a built-in attribute of many public blockchains fairly than “somebody’s fault,” but it could nonetheless invalidate transactions in a manner monetary operators can’t settle for.

Kim Seok-hwan illustrated,

“Think about a financial institution or card firm utilizing blockchain to course of stablecoin funds. If a sequence reorganization happens inside a minute, all fee information could possibly be canceled.”

So StableNet is being positioned as a “Okay-finance” infrastructure play: compliance-first design, predictable charges, and a privateness function that also permits oversight responses,

“Most public blockchains aren’t designed for monetary establishments that require transactional finality and reliability. That’s why we’re constructing a devoted mainnet specialised for on-chain finance.”

The Friction is Belief Not Code

A series can declare compliance, nevertheless it nonetheless should earn belief from the establishments it desires to serve.

StableNet’s pitch runs right into a structural stress with out absolutely stating: financial-grade auditability and consumer privateness pull in reverse instructions. If you happen to make privateness robust sufficient to guard industrial confidentiality, regulators and auditors demand stronger controls and clearer disclosure pathways. If you happen to make audit controls too heavy, customers begin to ask whether it is meaningfully completely different from standard finance databases.

Wemade’s reply is “selective privateness” by means of secret accounts plus audit readiness. Whereas which will sound neat on paper, the actual check is operational: who’s allowed to disclose what, underneath which course of, and the way disputes get dealt with.

There’s additionally an adoption friction baked into the thesis itself. By arguing that “generic public chains” are a poor match for institutional on-chain finance, Wemade is implicitly saying companions should be part of a brand new ecosystem with its personal requirements, tooling, and governance expectations.

That may be a excessive bar even when the tech works.

What StableNet Allows — and the Boundaries It Can’t But Cross

StableNet’s early rollout alerts what a compliance-first blockchain may virtually obtain inside Korea’s monetary system — and what nonetheless lies out of attain.

The platform’s largest purposeful leap is simplicity. By letting customers pay transaction charges immediately with a KRW stablecoin as a substitute of a separate fuel token, it removes one of many largest frictions for enterprises that should report each micro-transaction in native forex. For company treasurers and auditors, that change issues greater than advertising and marketing velocity claims.

Velocity is one other declare Wemade is betting on. The corporate says its WBFT consensus finalizes transactions in underneath a second and handles roughly 3,000 transactions per second. If these numbers maintain as soon as banks and fintech companions start testing, StableNet might shut the efficiency hole that has stored public chains from serving regulated finance.

And but, StableNet stays an experiment underneath scrutiny. It’s not regulatory approval — solely a design constructed for compliance. Korea’s central financial institution has not endorsed any personal stablecoin community, and even the best-engineered system nonetheless wants authorized readability earlier than giant establishments will settle real-money transfers on it.

There’s additionally the testnet caveat. Each metric unveiled thus far — velocity, privateness, interoperability — exists in a managed atmosphere. Scaling to manufacturing, the place latency, audits, and liquidity collide, is a special check fully.

Most essentially, StableNet continues to be infrastructure, not an energetic forex. It supplies the rails, however adoption will depend upon which licensed entities select to subject and distribute a KRW-backed stablecoin by means of it.

Till that occurs, StableNet represents a technical basis — not but a functioning market.

StableNet vs Typical Public-Chain Assumptions

| Matter | Stablenet Positioning | Typical Public-Chain Ache Level |

| Transaction charges | Charges paid utilizing KRW stablecoin; no separate fuel token | Charges typically paid utilizing risky tokens, complicating accounting |

| Transaction finality | Claimed near-instant finality through WBFT | Settlement finality might be slower or probabilistic |

| Reversals / reorg danger | Constructed to keep away from finance-disrupting reversals | Chain reorg danger framed as unacceptable for finance use |

| Privateness and audit | Secret accounts plus audit readiness. | Transactions and counterparties typically absolutely seen on-chain |

What international stakeholders ought to watch if Korea strikes towards KRW stablecoin issuance

For international buyers and builders, the sensible takeaway shouldn’t be “Wemade enters crypto.” It’s that Korean actors are more and more framing stablecoin infrastructure as regulated monetary plumbing, not as an extension of open crypto tradition.

Three watchpoints surfaced:

- Institutional associate pull: StableNet’s “precedence accounts” and audit-ready privateness options are geared toward corporates and monetary establishments. The primary credible sign will likely be named pilots and utilization patterns, not advertising and marketing language.

- Privateness posture underneath compliance: “secret transfers” inside a system that also helps audit responses is a fragile center floor. If it really works, it turns into a template others will copy. If it fails, the market snaps again to completely clear rails for security.

- Interoperability expectations: the stories point out exterior tokens and sensible app-like UX targets. International readers ought to watch how the ecosystem handles real-world integration, not simply chain efficiency.

StableNet: Betting on Governance Expectations, Not Simply Quicker Blocks

StableNet reads like an infrastructure workforce responding to a particular institutional concern: finance can’t run on rails which will “technically be high quality” however behave unpredictably on the worst second.

Wemade is betting that Korea’s stablecoin future, if it arrives, will reward techniques constructed for compliance workflows and auditability, even when that makes the ecosystem much less open and extra demanding to hitch.

If that guess is true, the following stablecoin benefit in Korea might come from who can fulfill regulators and companions with out humiliating customers’ privateness, not who can ship the flashiest token.

Key Takeaway on StableNet by Wemade

- Verified growth: Wemade opened the StableNet testnet on January 30, positioning it as KRW stablecoin-focused infrastructure, not a basic public chain.

- Clear details: charges paid in KRW stablecoin (no fuel token), WBFT-based near-instant finality claims, and “secret account” privateness constructed for audit readiness.

- Core stress: privateness that protects delicate transactions has to coexist with audit and compliance expectations that demand controllability.

- Sensible restrict: “compliance-ready design” doesn’t equal regulatory approval, and a testnet shouldn’t be proof of institutional adoption.

- International relevance: Korea’s stablecoin infrastructure dialog is transferring towards “regulated monetary rails,” with design decisions formed by institutional settlement and oversight calls for.

– Keep Forward in Korea’s Startup Scene –

Get real-time insights, funding updates, and coverage shifts shaping Korea’s innovation ecosystem.

➡️ Observe KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Fb, and WhatsApp Channel.

Elevate your perspective with NextTech Information, the place innovation meets perception.

Uncover the newest breakthroughs, get unique updates, and join with a world community of future-focused thinkers.

Unlock tomorrow’s tendencies right this moment: learn extra, subscribe to our publication, and develop into a part of the NextTech group at NextTech-news.com